Business

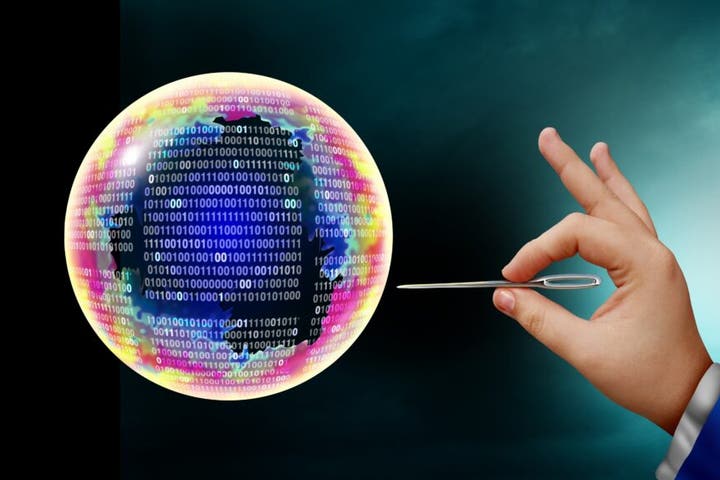

Wall Street Faces Volatility as AI Investment Warnings Emerge

Major concerns about the sustainability of investment in artificial intelligence (AI) have surfaced following a warning from Peter Berezin, Chief Global Strategist at BCA Research. In a post on X, Berezin highlighted that leading cloud and AI infrastructure providers—referred to as hyperscalers—could hold more than $2.5 trillion in AI assets by 2030. He speculates that these companies, including tech giants like Microsoft, Alphabet (parent company of Google), and Amazon, might incur approximately $500 billion annually in depreciation expenses due to a typical 20% depreciation rate.

The implications of such depreciation are significant. Berezin indicated that this level of expense could surpass the projected combined profits of these firms for 2025, raising critical questions about whether the current rate of AI investment is sustainable. His comments come in the wake of a turbulent day on Wall Street, where major technology stocks experienced declines.

Investor enthusiasm initially sparked by strong earnings from Nvidia was tempered by renewed worries over the high valuations of AI companies and the aggressive investments being made by tech leaders such as Amazon, Meta, and Oracle in the data centers required for generative AI. As a result, the Nasdaq Composite fell by 2.2% after an early boost, while the S&P 500 dropped by 1.6%. This downturn extended to Asian markets on Friday, where key indexes also recorded losses.

Concerns Over AI Investment Sustainability

Berezin’s warning resonated with a segment of users who questioned the rationale behind continued spending in light of these unfavorable projections. In response, he stated, “If the music is playing, you have to keep dancing,” emphasizing the prevailing pressure on companies to maintain momentum in their investments despite potential financial burdens.

Opinions among users were divided. Some expressed apprehension that high depreciation could strain profit margins if AI revenue growth were to slow. Others suggested that hyperscalers might mitigate financial impacts by extending equipment lifecycles or repurposing older hardware for less demanding tasks.

This analysis by Berezin introduces additional concerns about the potential accounting challenges posed by the ongoing AI arms race. Market observers are increasingly questioning whether investors have fully accounted for these implications. As the landscape evolves, the balance between aggressive investment and realistic financial returns remains a critical topic for stakeholders in the technology sector.

The unfolding situation presents a notable moment for investors and analysts alike, as they navigate the complexities of a rapidly changing market landscape influenced heavily by technological advancements and economic realities.

-

Top Stories1 week ago

Top Stories1 week agoPiper Rockelle Shatters Record with $2.3M First Day on OnlyFans

-

Top Stories5 days ago

Top Stories5 days agoMeta’s 2026 AI Policy Sparks Outrage Over Privacy Concerns

-

Sports4 days ago

Sports4 days agoLeon Goretzka Considers Barcelona Move as Transfer Window Approaches

-

Top Stories1 week ago

Top Stories1 week agoUrgent Update: Denver Fire Forces Mass Evacuations, 100+ Firefighters Battling Blaze

-

Top Stories1 month ago

Top Stories1 month agoRachel Campos-Duffy Exits FOX Noticias; Andrea Linares Steps In

-

Top Stories1 week ago

Top Stories1 week agoOnlyFans Creator Lily Phillips Reconnects with Faith in Rebaptism

-

Entertainment4 days ago

Entertainment4 days agoTom Brady Signals Disinterest in Alix Earle Over Privacy Concerns

-

Top Stories6 days ago

Top Stories6 days agoOregon Pilot and Three Niece Die in Arizona Helicopter Crash

-

Health2 months ago

Health2 months agoTerry Bradshaw Updates Fans on Health After Absence from FOX NFL Sunday

-

Top Stories3 days ago

Top Stories3 days agoCBS Officially Renames Yellowstone Spin-off to Marshals

-

World1 week ago

World1 week agoTragedy in Crans-Montana: Fire Claims Lives of Holiday Revelers

-

Top Stories4 days ago

Top Stories4 days agoWarnock Joins Buddhist Monks on Urgent 2,300-Mile Peace Walk