Top Stories

Mortgage Rates Plunge to 6.06%: Immediate Homebuyer Surge

BREAKING: Mortgage rates in the United States have just fallen to a stunning 6.06%, the lowest level since 2022. This significant drop has already sparked a rush in home purchases and refinancing, revitalizing a market that had shown signs of cooling. Homebuyers are quickly evaluating strategies to take advantage of these favorable conditions.

According to data released by Freddie Mac on January 15, 2026, the 30-year fixed-rate mortgage fell to 6.06%, down from 7.04% this time last year. The 15-year fixed rate also decreased to 5.38%, its lowest since October 2024. This decline presents a pivotal opportunity for consumers looking to buy or refinance.

In the wake of these changes, mortgage activity has surged. The Mortgage Bankers Association (MBA) reported a staggering 28.5% increase in total mortgage application volume week-over-week, with refinancing applications rising nearly 40%. This strong demand follows an urgent announcement from President Donald Trump, who stated he would direct Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities to further reduce rates for consumers.

The announcement led to a temporary dip in the 30-year fixed rate below 6% before stabilizing slightly higher. This flurry of activity is particularly significant as it coincides with the post-holiday period, traditionally seen as a slower time for real estate transactions.

Experts Confirm: The drop in mortgage rates is more than just seasonal. Joel Kan, chief economist at MBA, emphasized that this movement is a genuine shift driven by lower rates, combined with efforts from the White House to stimulate the housing market. Kan noted that existing home sales in December rose at their fastest pace in three years, highlighting the urgent need for potential buyers to act swiftly.

For consumers, the implications are clear: securing a loan now could mean substantial savings compared to last year. However, not everyone will qualify for the best rates.

To maximize loan terms, consumers are encouraged to focus on their credit scores, as even a slight improvement can lead to significant savings. Maintaining timely payments, reducing credit card balances, and carefully comparing offers from various lenders can make a crucial difference.

The 30-year average contractual rate saw a slight drop to 6.18% from 6.25%, applicable to conforming loans up to $832,750 with a 20% down payment. Meanwhile, points decreased from 0.57 to 0.56, including the origination fee.

In this rapidly changing environment, consumers must evaluate their options. The right mortgage term can also significantly impact long-term costs; 15-year mortgages typically offer lower rates but come with higher monthly payments. Evaluating job stability and household budgets is essential before making decisions.

Finally, locking in a rate at the optimal moment is critical, ensuring protection against potential increases in the future.

As White House Press Secretary Karoline Leavitt stated, “Monthly housing payments are now at their lowest level in two years, and we expect this downward trend to continue.”

This is a moment that homebuyers cannot afford to overlook. The window of opportunity is limited, and those who prepare and act quickly may enjoy substantial savings that could last for decades.

Stay tuned as we continue to monitor this developing situation and provide updates on mortgage rates and housing market trends.

-

Top Stories1 month ago

Top Stories1 month agoRachel Campos-Duffy Exits FOX Noticias; Andrea Linares Steps In

-

Top Stories2 weeks ago

Top Stories2 weeks agoPiper Rockelle Shatters Record with $2.3M First Day on OnlyFans

-

Top Stories2 weeks ago

Top Stories2 weeks agoMeta’s 2026 AI Policy Sparks Outrage Over Privacy Concerns

-

Sports2 weeks ago

Sports2 weeks agoLeon Goretzka Considers Barcelona Move as Transfer Window Approaches

-

Top Stories2 weeks ago

Top Stories2 weeks agoUrgent Update: Denver Fire Forces Mass Evacuations, 100+ Firefighters Battling Blaze

-

Health2 months ago

Health2 months agoTerry Bradshaw Updates Fans on Health After Absence from FOX NFL Sunday

-

Sports1 week ago

Sports1 week agoSouth Carolina Faces Arkansas in Key Women’s Basketball Clash

-

Top Stories2 weeks ago

Top Stories2 weeks agoOnlyFans Creator Lily Phillips Reconnects with Faith in Rebaptism

-

Top Stories1 week ago

Top Stories1 week agoCBS Officially Renames Yellowstone Spin-off to Marshals

-

Top Stories2 weeks ago

Top Stories2 weeks agoOregon Pilot and Three Niece Die in Arizona Helicopter Crash

-

Entertainment2 weeks ago

Entertainment2 weeks agoTom Brady Signals Disinterest in Alix Earle Over Privacy Concerns

-

Top Stories2 weeks ago

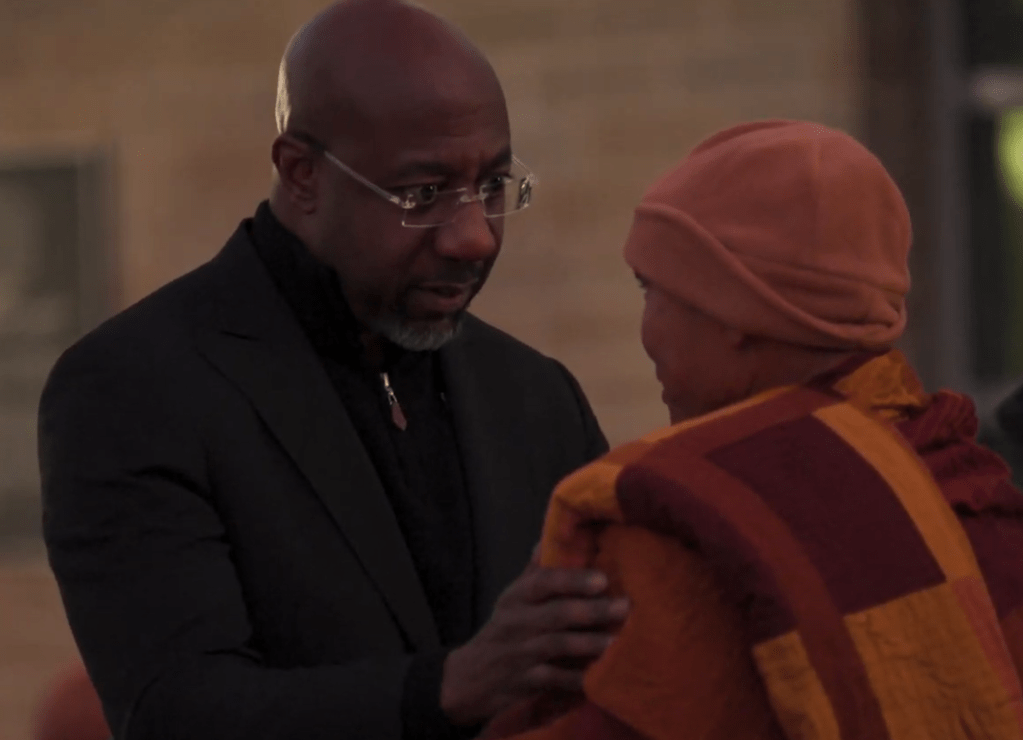

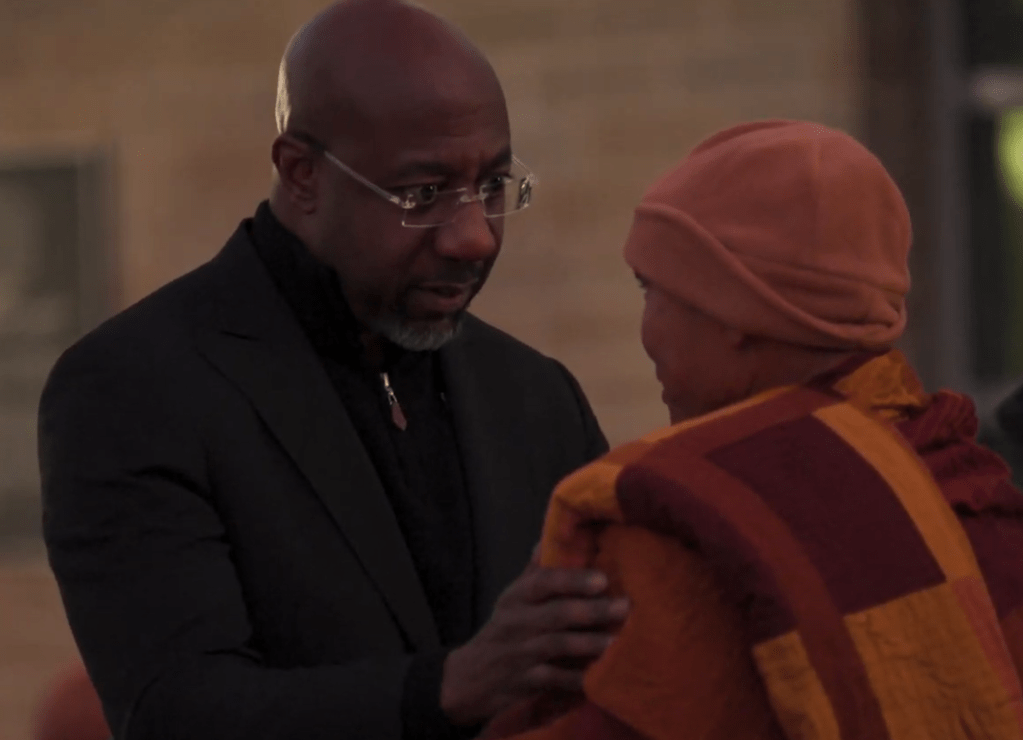

Top Stories2 weeks agoWarnock Joins Buddhist Monks on Urgent 2,300-Mile Peace Walk