WASHINGTON (AP) — An analysis by the JPMorganChase Institute has revealed that U.S. employers could face a direct cost of $82.3 billion due to President Donald Trump’s tariff plans. This financial burden may lead companies to consider price hikes, layoffs, hiring freezes, or reduced profit margins as potential strategies to manage the impact.

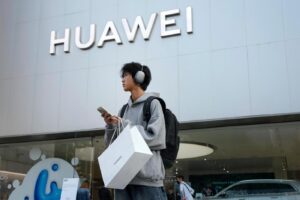

The study focuses on businesses with annual revenues ranging from $10 million to $1 billion, a segment that encompasses about one-third of private-sector U.S. workers. These companies are particularly reliant on imports from countries like China, India, and Thailand, making them vulnerable to the import taxes imposed by the Trump administration. The retail and wholesale sectors, in particular, are expected to feel the brunt of these tariffs.

Contradicting Presidential Claims

The findings challenge President Trump’s assertion that foreign manufacturers would bear the costs of the tariffs. Instead, the analysis indicates that U.S. companies dependent on imports will absorb these expenses. While the tariffs have not yet significantly affected overall inflation, major corporations such as Amazon, Costco, Walmart, and Williams-Sonoma have mitigated immediate impacts by stockpiling inventory before the tariffs took effect.

“The $82.3 billion cost is equivalent to an average of $2,080 per employee, or 3.1% of the average annual payroll,” the report states.

This analysis arrives just before the July 9 deadline for Trump to finalize tariff rates on goods from numerous countries. The president set this deadline following market turmoil in response to his April tariff announcements, opting for a 90-day negotiation period where most imports faced a 10% baseline tariff. China, Mexico, and Canada face higher rates, with separate 50% tariffs on steel and aluminum.

Implications for U.S. Businesses

Had the initial tariffs announced in April remained, companies in the analysis would have faced additional direct costs of $187.6 billion. The potential financial strain underscores the complex trade-offs involved in the tariff strategy.

Goldman Sachs has projected that companies might pass along 60% of their tariff costs to consumers. Similarly, the Atlanta Federal Reserve’s survey suggests that businesses could transfer roughly half of their costs from a 10% or 25% tariff without significantly reducing consumer demand.

“Companies need to plan for a range of possible outcomes,” the JPMorganChase Institute advises, noting the precarious position of wholesalers and retailers operating on thin profit margins.

Uncertain Future of Tariffs

The outlook for tariffs remains uncertain, with ongoing negotiations and fluctuating trade policies. Trump recently halted and then resumed talks with Canada after it withdrew a plan to tax digital services. He also threatened additional tariffs on Japan unless it increases rice imports from the U.S.

Treasury Secretary Scott Bessent expressed optimism about the trade discussions, stating that the concessions achieved have impressed long-serving officials at the Office of the U.S. Trade Representative and other agencies.

“People who have been at Treasury, at Commerce, at USTR for 20 years are saying that these are deals like they’ve never seen before,” Bessent remarked on Fox News Channel’s “Fox & Friends.”

Next Steps and Economic Impact

The Trump administration plans to outline the contours of trade deals in the coming week, prioritizing the tax cuts package recently passed by the Republican-majority Senate. Trump has set a Friday deadline for the passage of this multitrillion-dollar package, aiming to offset its costs with tariff revenues.

As the 90-day negotiation period concludes, only the United Kingdom has formalized a trade framework with the U.S., while India and Vietnam are reportedly close to reaching agreements. The evolving trade landscape continues to pose challenges and opportunities for U.S. businesses navigating the complexities of international commerce.