Southern California Homebuyers Surge Amid Dropping Mortgage Rates

UPDATE: Southern California homebuyers are responding to falling mortgage rates in a significant way, with data revealing the busiest September for real estate since 2022. As rates drop, house hunters are becoming more active, even as uncertainty looms over the job market and consumer confidence remains shaky.

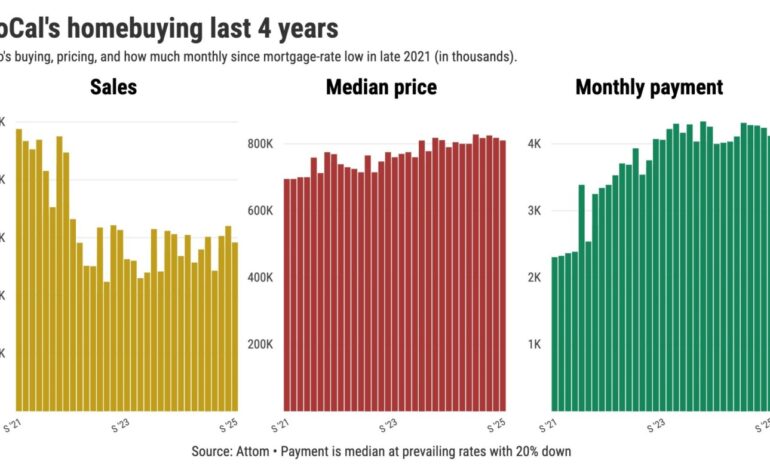

Recent data compiled from Attom and Freddie Mac indicates that 14,590 homes sold in September, marking a 4% increase from the previous year. However, this surge contrasts sharply with historical averages, as it remains the fourth-slowest September since 2005. Just four years ago, sales were 67% higher at 24,392, highlighting a notable shift in the housing landscape.

Despite the uptick in sales, prices continue to climb. The median home price in the region stands at $810,000, which is only 2% below its record high of $830,000 reached in June 2025. This represents a 3% increase year-over-year, leaving many potential buyers grappling with affordability.

Homebuyers are seeing some relief in monthly payments. The estimated monthly house payment has dipped to $4,119, a 5% decrease from the peak of $4,327 in May 2024. However, it’s crucial to note that this figure is still up 79% over the past four years, raising questions about long-term affordability.

The inventory of homes for sale has also increased, with an average of 39,814 listings available in the three months leading to September—up 35% from last year. This escalation offers buyers more options compared to the pandemic’s ultra-low rates, which came with limited supply.

Interestingly, the market for condominiums has not reflected the same enthusiasm. Sales of 3,490 condos in September showed only a marginal increase of 0.3%, while their median price of $665,000 remains 5% below the peak of $700,000 in February 2025.

In contrast, single-family homes are witnessing a hotter market. The 11,100 sales in September represent a 5% year-over-year increase, with a median price of $865,000, just 2% below the record set earlier this year.

Regional differences are stark. While coastal areas like San Diego and Los Angeles are experiencing sales growth—11% and 9% respectively—sales in more affordable regions like San Bernardino saw a 13% decline. With 1,781 sales recorded in San Bernardino and a flat median price of $520,250, the impact of declining mortgage rates is less pronounced in these areas.

As buyers across the state respond similarly, California as a whole saw 27,933 sales in September, up 4% year-over-year. However, this still reflects a significant drop from September 2021 figures, which were 66% higher.

Nationwide, U.S. buyers purchased 339,867 homes in September, a 2% increase from the previous year. The national median home price has reached $361,058, up 2% and just below its high of $370,000 in June 2025.

As the housing market continues to evolve, potential buyers are encouraged to stay informed about changing rates and inventory levels. The interplay between mortgage rates and home prices will remain a critical factor in the ongoing real estate landscape.

For further updates and insights, follow Jonathan Lansner, business columnist for the Southern California News Group, at [email protected].