Social Security Fund Faces Sooner Insolvency Due to Tax Law

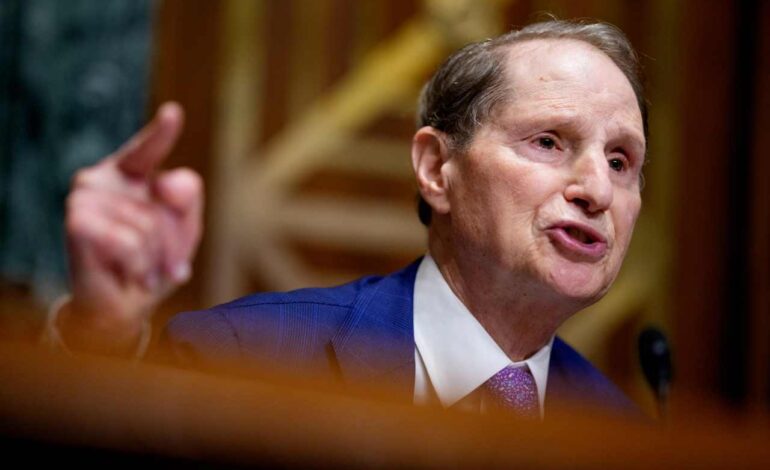

URGENT UPDATE: The Social Security Old-Age and Survivors Trust Fund may run out of money sooner than anticipated, according to a warning from a prominent senator. New reports confirm that changes introduced by the recent Republican tax law will accelerate the fund’s insolvency, raising alarms for millions of Americans relying on these benefits.

The Social Security Administration’s chief actuary has indicated that the fund, which currently holds approximately $20 trillion, could face insolvency as early as 2023. This revelation poses a significant threat to the financial security of countless retirees and survivors, who depend on these essential benefits for their livelihood.

Senator [Name], who has been vocal on this issue, emphasized that the implications of this tax law extend far beyond politics. “This is not just a fiscal issue—this is about the lives of everyday Americans,” he stated. The senator’s remarks reflect a growing concern among government officials and citizens alike regarding the sustainability of Social Security in light of new fiscal policies.

The urgency of this situation is underscored by the fact that the trust fund was already projected to face challenges before these recent tax changes. Analysts warn that the combination of reduced revenue from the new tax policies and increased demand for Social Security benefits will compound the existing crisis.

As debates continue in Washington, the focus now shifts to potential legislative solutions to stabilize the fund. Lawmakers are under pressure to address these alarming projections and to reassure the public that Social Security will remain intact for future generations.

Experts highlight that if immediate actions are not taken, millions could face significant cuts to their benefits, dramatically affecting their quality of life. “We cannot ignore the fact that Social Security is a cornerstone of financial security for many Americans,” said [another expert or official], reinforcing the emotional weight of this developing crisis.

The Social Security Administration has yet to release a comprehensive plan to address the impending insolvency. Stakeholders from various sectors are calling for urgent discussions to explore viable options that could avert a financial disaster.

As this story develops, the implications for the American workforce, retirees, and future beneficiaries become increasingly critical. The urgency for effective policy intervention has never been clearer, and all eyes are on Congress as they navigate this complex and pressing issue.

Stay tuned for further updates as this situation evolves. The future of Social Security, and the well-being of millions, hangs in the balance.