NZD/USD Plummets Below 0.6000: Is More Decline Ahead?

UPDATE: The New Zealand Dollar (NZD) has plunged below the critical 0.6000 support level against the US Dollar (USD), signaling potential further declines. This fresh downward movement comes as traders react to significant market pressures, with analysts warning of more pain on the horizon.

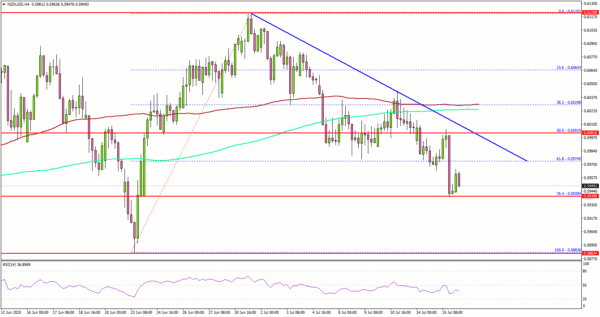

The NZD/USD pair started its latest decline from a high of 0.6120 and has now dipped below 0.6050 and 0.6020. Recent technical analysis reveals a key bearish trend line forming, indicating resistance at 0.6000 on the 4-hour chart.

This immediate drop is critical, as the pair now trades below both the 50% Fibonacci retracement level and the 200 simple moving average. Current immediate support is noted at approximately 0.5940, closely aligned with the 76.4% Fibonacci retracement level of the recent upward movement.

Market experts highlight that if the NZD/USD continues to lose ground, it may soon approach the 0.5900 support zone. A breach below this level could see the pair targeting the 0.5880 area, intensifying concerns among traders.

In related developments, the Euro has also faced pressure, with the EUR/USD pair extending losses below the 1.1650 and 1.1620 levels. This decline further emphasizes the volatility in the currency markets and the challenges facing traders.

Looking ahead, the upcoming release of the US Producer Price Index for June 2025 is expected to influence market trends. Analysts forecast a Month-over-Month (MoM) increase of 0.2%, slightly up from the previous 0.1%, while the Year-over-Year (YoY) figure is anticipated to be 2.5%, down from 2.6%.

As the situation develops, traders are advised to monitor key resistance levels, particularly around 0.6000 and 0.6030. A close above 0.6030 could pave the way for a renewed upward movement, potentially reaching back towards the 0.6120 resistance.

This market turmoil has significant implications for traders and investors globally, highlighting the urgency and unpredictability of the current economic landscape. Stay tuned for further updates as this story develops.