Nvidia Surpasses $1 Trillion Market Value; $5 Trillion Next?

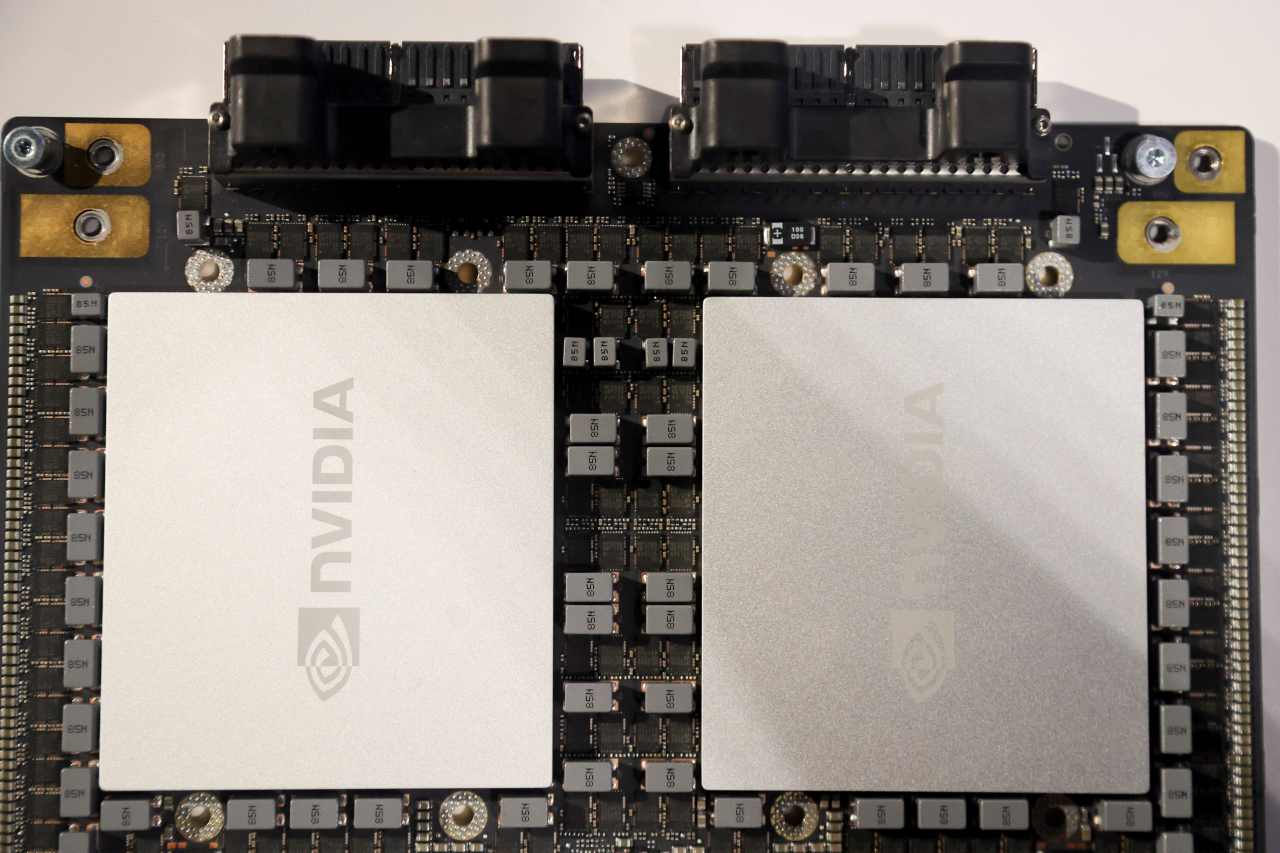

Nvidia has achieved a historic milestone by becoming the first publicly traded company to surpass a market valuation of **$1 trillion**. This remarkable achievement reflects the growing demand for its advanced graphics processing units (GPUs) and artificial intelligence (AI) technology, which have become crucial in various sectors, including gaming, data centers, and automotive industries.

The surge in Nvidia’s stock price has been largely driven by its dominant position in the semiconductor industry. The company’s innovative products are at the forefront of AI advancements, revolutionizing how businesses operate and consume technology. According to a recent report by Morgan Stanley, this unprecedented growth could pave the way for Nvidia to reach a market valuation of **$5 trillion** in the coming years, especially if the current momentum in AI adoption continues.

Driving Forces Behind Nvidia’s Success

Under the leadership of CEO **Jensen Huang**, Nvidia has consistently pushed the boundaries of technology. The company’s GPUs have become essential for AI applications, enabling faster processing and enhanced capabilities. As organizations increasingly leverage AI for everything from data analysis to autonomous vehicles, Nvidia’s role becomes even more critical.

Wall Street analysts have recognized Nvidia’s potential, with many raising their price targets for the company’s stock. The excitement surrounding AI has prompted investors to re-evaluate Nvidia’s position in the market. With a reported **$2 billion** in revenue generated from AI-related products in the last quarter alone, Nvidia is well-positioned to capitalize on this trend.

Moreover, the global shift toward cloud computing and remote work has further accelerated the demand for high-performance computing. Nvidia’s technology is integral to powering cloud services, making it a key player in this evolving landscape.

Potential Challenges Ahead

Despite the optimistic outlook, Nvidia faces challenges that could impact its growth trajectory. The semiconductor industry is characterized by intense competition, with companies like AMD and Intel investing heavily in AI technologies. Additionally, potential regulatory measures concerning data privacy and AI ethics could pose hurdles for Nvidia’s expansion plans.

Moreover, as the tech market fluctuates, investor sentiment can shift rapidly. A downturn in the economy or adverse market conditions could affect Nvidia’s stock performance, making it essential for the company to maintain its innovative edge.

In conclusion, Nvidia’s achievement of a **$1 trillion** market value marks a significant milestone in the tech industry. With the potential to reach **$5 trillion**, the company’s future remains promising, albeit with challenges. As AI technology continues to advance, Nvidia’s influence will likely grow, solidifying its position as a leader in the semiconductor and tech sectors.