Millions Face Rising Health Care Costs as ACA Subsidies Expire

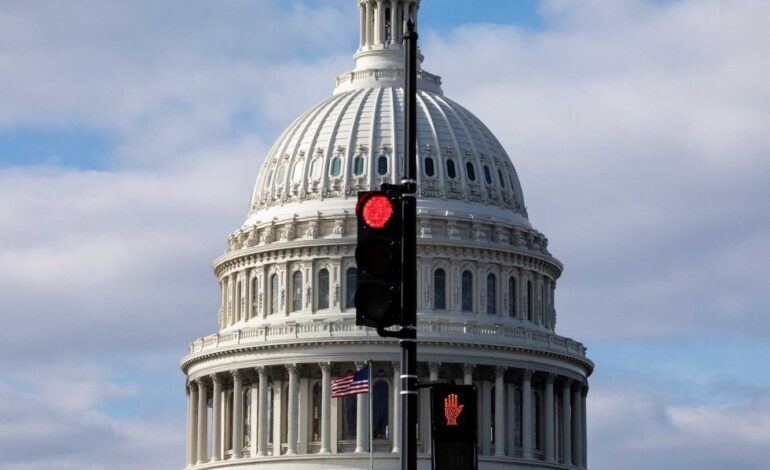

The deadline of December 15, 2025 for enrolling in a marketplace plan through the Affordable Care Act (ACA) has passed without an agreement on federal subsidies. This situation signals that millions of Americans relying on these subsidies will likely experience a significant increase in health care costs starting in 2026. Despite efforts in the House to extend these subsidies, Congress is set to adjourn for the year on December 19, leaving many consumers facing uncertain financial futures.

The ACA, enacted in 2010, marked a pivotal moment in the ongoing debate over health care responsibility in the United States. For decades, discussions have revolved around whether health care provision should be a government obligation or a personal responsibility. This debate has only intensified, as evidenced by a recent 43-day government shutdown beginning on October 1, 2025, rooted in disagreements over health care funding.

Prior to the ACA, approximately 49 million Americans lacked health insurance, a figure that had risen significantly following the 2008 recession. Many people lost their jobs and, consequently, their employer-sponsored health coverage. The ACA aimed to reduce the uninsured population by about 30 million, but as of now, around 26 million Americans remain uninsured, a statistic that fluctuates with economic changes and policy adjustments.

The legislation introduced various strategies to expand health coverage, including allowing young adults to remain on their parents’ insurance until age 26 and mandating that all individuals secure health insurance. However, the most impactful provisions were the expansion of Medicaid to cover individuals earning below 138 percent of the poverty line and providing subsidies for low- to moderate-income individuals purchasing insurance through the ACA marketplace.

Medicaid expansion has been contentious. While 40 states and the District of Columbia have adopted it, the Supreme Court ruled that the decision lies with individual states. Currently, about 20 million Americans benefit from Medicaid expansion, while the subsidy system has assisted millions in accessing insurance coverage.

The COVID-19 pandemic prompted significant increases in subsidy amounts, with legislation passed under the Biden administration eliminating premiums for the lowest-income individuals and extending qualifications for those earning above 400 percent of the federal poverty level. As of 2025, nearly 22 million Americans received federal subsidies to help afford marketplace plans, a substantial increase from 9.2 million in 2020.

The expiration of these enhanced subsidies at the end of 2025 is expected to lead to dramatic cost increases. For example, individuals earning $45,000 annually could see their monthly premium rise by 74 percent, translating to an additional $153 per month. Coupled with anticipated insurance price hikes of about 18 percent, many consumers could experience over a 100 percent increase in health insurance costs.

Proponents of extending the pandemic-era subsidies warn that failing to do so may result in 6 million to 7 million people exiting the ACA marketplace, with an estimated 5 million potentially becoming uninsured in 2026. Recent tax and spending laws, signed by former President Donald Trump, are adding to the challenges of maintaining insurance coverage, with projections suggesting Medicaid cuts could leave over 7 million individuals without coverage. The cumulative effect of these policies may result in as many as 16 million people becoming uninsured by 2034, reversing much of the progress made since the ACA’s inception.

The debate surrounding these subsidies is charged, as critics argue that they inflate the federal health care budget and disproportionately benefit higher-income individuals. Additionally, there is concern that employers are reducing their healthcare responsibilities, with a significant decline in health insurance offerings from companies with 25 to 49 employees since the ACA’s introduction.

The U.S. health care system remains the most expensive globally, and rising uninsured rates could lead to higher overall costs due to decreased access to preventive care. Nationally, about 8 percent of individuals under 65 were uninsured in 2023, but this rate varied significantly by state, from 3 percent in Massachusetts to 18.6 percent in Texas. As the political landscape influences health care policies, the divergence in solutions reflects broader ideological divides.

Proponents of government responsibility for health care argue for expanded coverage financed through taxation, while advocates for market solutions emphasize competition among insurers as a more effective remedy for rising costs. Without consensus on the fundamental question of health care responsibility, the U.S. appears poised to remain entrenched in this contentious debate for years to come.