Crude Oil Surges Over 2% as Trump Targets Russian Giants

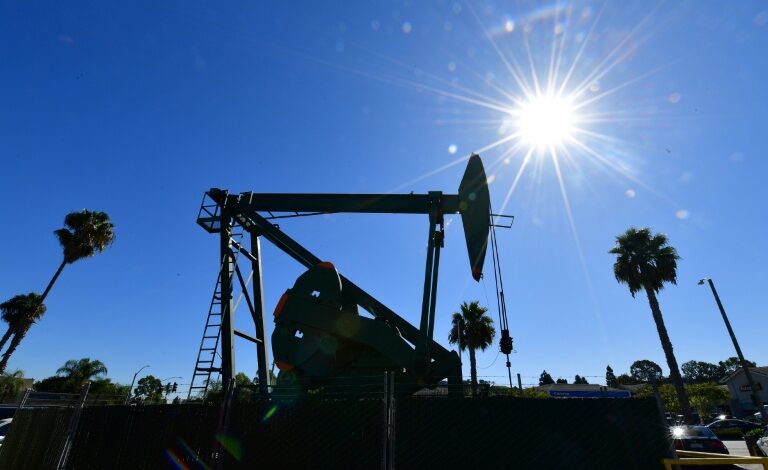

UPDATE: Crude oil prices surged more than 2% on Thursday as Donald Trump announced hefty sanctions against Russian oil giants Rosneft and Lukoil. The announcement sent both Brent and West Texas Intermediate (WTI) crude contracts up nearly 3%, reflecting escalating tensions amid ongoing geopolitical conflicts.

This dramatic price spike comes on the heels of Trump’s remarks regarding stalled peace efforts with Vladimir Putin, stating, “Every time I speak with Vladimir, I have good conversations, and then they don’t go anywhere.” The sanctions were prompted by the collapse of a planned summit in Budapest this week, intensifying the international community’s pressure on Moscow to end its invasion of Ukraine.

As oil prices hit near two-week highs, boosted by claims that India may cut its Russian oil imports as part of a trade deal with the United States, market analysts are closely monitoring the situation. However, New Delhi has yet to confirm these reports.

In stark contrast, equity markets fell sharply, with major Asian indices like Tokyo’s Nikkei 225 down 1.3% and Hong Kong’s Hang Seng Index down 0.6%. Investors are growing uneasy about a potential end to the tech-led surge that has propelled stocks to record highs this year, leading some to warn of a possible market bubble.

Adding to the market turmoil, there are concerns about a potential curtailment of software exports to China. Reports suggest the U.S. administration is considering restrictions on various tech exports, including laptops and jet engines, due to China’s control over rare earth minerals. Scott Bessent, U.S. Treasury Secretary, emphasized, “Everything is on the table,” indicating that these measures could align with U.S. allies in the G7.

The uncertainty surrounding these developments has raised alarm among investors. Analysts note that while a full-blown crisis seems unlikely, the implications of possible export controls could inject significant risk into U.S.-China trade negotiations.

Despite the volatility, gold prices have slightly rebounded, edging up around 1% to $4,075, although it remains well below its record high of $4,381 earlier this week.

As the international community watches closely, the upcoming APEC summit in South Korea may provide a platform for Trump and Chinese officials to discuss these escalating tensions. However, Trump’s recent remarks hint at uncertainty regarding the meeting’s occurrence.

Investors are advised to stay vigilant as geopolitical developments continue to unfold. The ramifications of these sanctions and trade discussions could have lasting impacts on global markets, making this a critical moment to watch.

Stay tuned for more updates as the situation develops.