California Homeowners Lose $33,000 in Equity in Just One Year

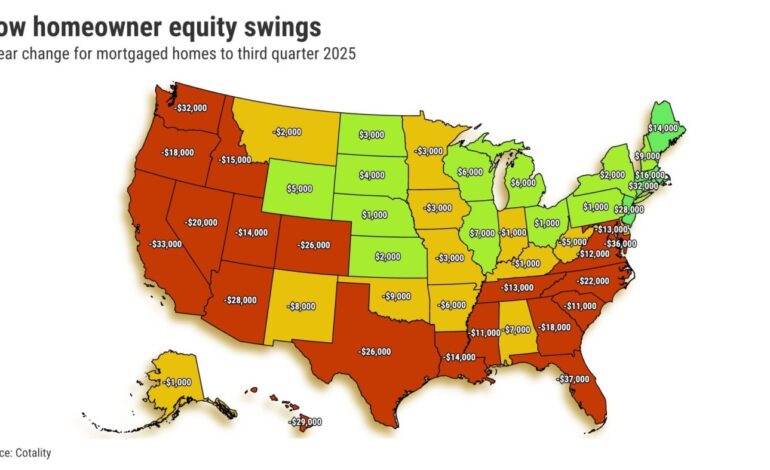

BREAKING: California homeowners have lost an average of $33,000 in home equity over the past year, according to a new report by Cotality, released earlier today. This dramatic decline, noted from the year ending in September 2025, is more than double the national average drop of $13,000.

This urgent update highlights the growing concerns among homeowners as equity declines in 33 states amid falling home values. Florida leads the nation with the largest drop in equity, down $37,000, followed closely by the District of Columbia at $36,000 and Washington State at $32,000.

The report also reveals that despite this year’s equity loss, Californians still maintain a significant equity cushion, averaging $603,000 per mortgaged home. This figure is more than double the national average of $299,000, placing California second only to Hawaii, where homeowners enjoy an average of $674,000 in equity.

While the 5% decline in California’s home equity positions it as the 16th-worst among states, the percentage drop is relatively modest compared to other states experiencing sharper declines. States like Texas, Florida, and Louisiana have seen 12% drops, significantly impacting homeowners’ financial stability.

Cotality’s report indicates that just 0.9% of California borrowers are currently underwater, sharing the top spot with Nevada for the lowest percentage in the nation. In comparison, the national average for underwater mortgages stands at 2.2%, with Louisiana leading at 6.9%.

The emotional impact of these findings cannot be overstated. Many Californian families are grappling with the implications of losing such a substantial equity stake while still holding on to a significant amount of equity. This decline could limit their financial options in times of need.

As the housing market continues to fluctuate, experts urge homeowners to stay informed about their equity status and prepare for potential challenges ahead. Homeowners should closely monitor their mortgage balances and market conditions to make informed decisions regarding their real estate investments.

Moving forward, the focus remains on how these trends will affect the California housing market in the coming months. Homeowners are advised to seek financial advice and consider their options carefully.

Stay tuned for more updates on this developing story, as the implications of falling home equity continue to unfold across the nation.