Apple Overtakes Nvidia in Market Cap Amid AI Shift

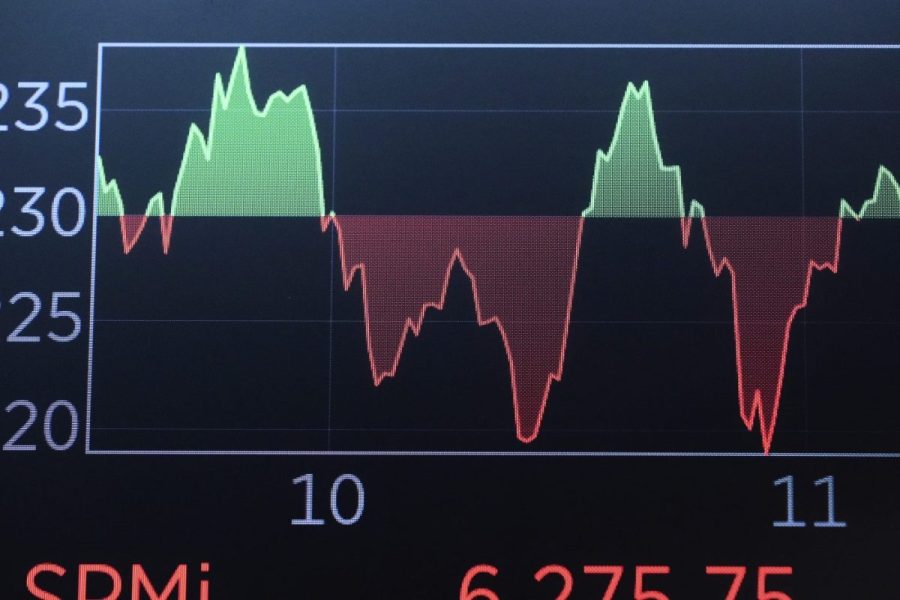

UPDATE: In a stunning market shift, Apple has reclaimed its position as the world’s most valuable company, overtaking Nvidia as of July 2023. This transition highlights a critical pivot in the tech industry, revealing a growing preference for consumer-focused AI monetization over infrastructure investments.

Recent reports from 9to5Mac confirm that institutional investors are recalibrating their strategies, moving away from Nvidia’s dominance in AI infrastructure towards Apple’s robust ecosystem. As the market evaluates the future of AI, a clear distinction is emerging: while Nvidia provides the hardware, Apple is focused on integrating AI into everyday devices like the iPhone 16.

This shift is significant. With AI infrastructure costs mounting, cloud providers are under pressure to demonstrate tangible returns on investment. Analysts from Bloomberg note that Apple’s comprehensive approach—leveraging its user base for sustained revenue—positions it favorably against Nvidia’s volatile capital expense cycles.

The transition from Nvidia’s hardware-centric model to Apple’s consumer-oriented strategy underscores a vital change in market sentiment. While Nvidia has thrived on its AI chip sales, Apple is set to monetize AI through its expansive services and hardware upgrades. The potential for a “super-cycle” of iPhone upgrades is gaining traction, driven by AI capabilities that older devices cannot support.

This recalibration also reflects a broader trend towards quality and sustainability in tech investments. The Wall Street Journal reports that investors are increasingly skeptical of Nvidia’s high price-to-earnings ratios, questioning the sustainability of its rapid growth. In contrast, Apple’s strategy of integrating AI into its products and services is seen as a more reliable revenue model.

Apple’s emphasis on “Edge AI” technology is particularly noteworthy. By processing AI tasks on devices rather than in the cloud, Apple addresses critical issues of latency and privacy that plague the generative AI landscape. The company’s strong relationship with TSMC ensures it has first access to advanced chip technologies, further solidifying its competitive edge.

As Apple rolls out its own AI-driven features, its services division is evolving into a lucrative revenue stream—one that analysts predict could enhance its valuation significantly. This aligns with the company’s history of monetizing its user base continuously, as opposed to Nvidia’s one-time hardware sales model.

Moreover, Apple’s diversified supply chain strategy mitigates risks that Nvidia faces, especially in the wake of geopolitical tensions. Recent restrictions on Nvidia’s chip sales to China have heightened concerns about its revenue prospects in the world’s second-largest economy. In contrast, Apple’s ability to maintain its luxury brand status in China, combined with its supply chain investments in India and Vietnam, positions it favorably amidst these challenges.

The current market environment also favors established companies like Apple. As the largest component of major indices like the S&P 500, it benefits from consistent passive inflows, providing stability in uncertain economic times. Investors are gravitating towards Apple’s proven business model, signaling a significant shift in market dynamics.

As of now, the narrative is clear: while Nvidia built the AI infrastructure, Apple is creating the user experience that will drive future demand. The stock market’s reaction indicates that investors are betting on Apple’s ability to integrate AI into everyday life, suggesting that the future of AI lies not just in data centers, but also in consumers’ hands.

The implications of this shift are profound, as the tech landscape continues to evolve. As Apple reclaims its crown, the focus on consumer-driven AI solutions marks a pivotal moment in the ongoing competition between these two tech giants. Investors and consumers alike will be watching closely as this story unfolds.