Navigating Life Sciences Regulation: Key Insights for Startups

Life sciences represent one of the most regulated sectors globally, impacting the journey of startups, legal professionals, and investors alike. From developing innovative cancer therapies to launching dietary supplements, regulatory frameworks dictate not only the market entry of products but also influence funding opportunities and exit strategies. Understanding these regulations is crucial, as they can shape investors’ perceptions of risk and determine the compliance infrastructure necessary from the outset.

Key Regulatory Bodies and Global Implications

In the United States, the Food and Drug Administration (FDA) serves as the primary regulatory authority. Within the FDA, products are categorized into specialized centers, including the Center for Biologics Evaluation and Research (CBER), the Center for Drug Evaluation and Research (CDER), the Center for Devices and Radiological Health (CDRH), the Center for Tobacco Products (CTP), and the Center for Veterinary Medicine (CVM). As companies operate internationally, they must also navigate local health authorities, which can present varying standards and timelines.

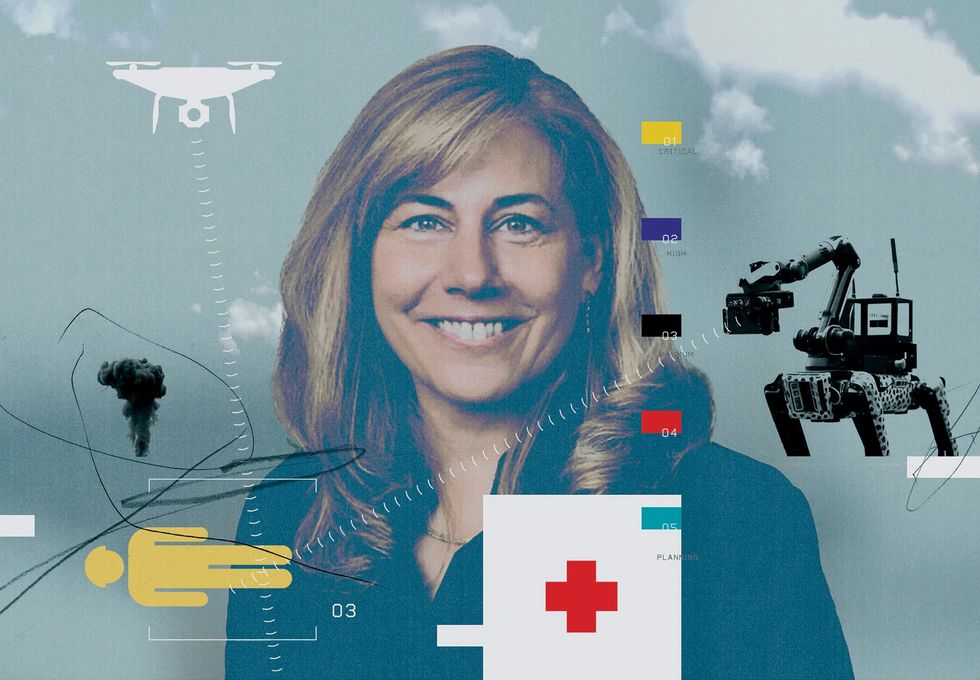

Denise Esposito of Covington emphasizes the importance of understanding not only the FDA’s regulations but also how they interact with global agencies. For instance, while the FDA may accept surrogate endpoints in trials for rare diseases, the European Medicines Agency often requires longer-term outcome data.

Regulatory environments can also vary significantly. Not all health-related products fall under FDA oversight. A product classified as a cosmetic may become a drug if it claims to treat or diagnose diseases. Similarly, a mobile app may only need to comply with general consumer product standards unless it markets itself as a diagnostic tool.

The Drug Development Process and Its Challenges

The drug development journey is intricate, often taking years and involving several phases. Typically, it begins with Phase I, which includes around 20 to 100 participants to evaluate safety and dosage. Phase II expands this to 100 to 300 participants, focusing on efficacy and side effects. Phase III involves thousands of patients across multiple sites to confirm effectiveness and monitor adverse reactions.

However, challenges frequently arise, especially in fields like precision medicine and rare diseases, where patient recruitment can be particularly difficult. Delays in these stages can lead to significant financial repercussions for startups that may be operating on tight budgets.

Upon receiving approval, competitors can pursue generic or biosimilar pathways. A generic drug is chemically identical to a brand-name counterpart, while a biosimilar is “highly similar” to a biologic. These pathways not only enhance market access but also incite legal disputes over patents and exclusivity, with billions of dollars in revenue at stake.

For medical devices, the regulatory framework is classified by risk level. Class I devices, such as stethoscopes, are typically exempt from pre-market review, while Class II devices require a 510(k) clearance to demonstrate substantial equivalence to existing products. Class III devices, which include pacemakers and stents, necessitate Premarket Approval (PMA), requiring extensive safety and effectiveness data.

Howard Carolan of CoapTech highlights the importance of understanding these pathways, noting that the ability to utilize the 510(k) process can significantly impact a startup’s survival.

Jurisdictional gray areas further complicate the regulatory landscape. Combination products, which may involve a combination of drugs and devices, can challenge existing classifications. Consumer products can also fall into regulated categories, often without entrepreneurs realizing the implications.

Policy Changes and Their Impact

Recent shifts in policy underscore the vulnerabilities within the regulatory framework. In 2025, over 3,500 FDA employees were laid off, raising concerns about potential delays in product reviews. Additionally, drug pricing reforms, such as the “Most-Favored-Nation” executive order, have introduced new pressures on pharmaceutical margins.

Furthermore, cuts to funding from the National Institutes of Health (NIH) have left many startups scrambling for financial support. Mark Gardner of Gardner Law indicates that these policy changes can instantly affect financial forecasts, urging companies to stay vigilant regarding regulatory developments.

Regulation in the life sciences sector may appear daunting, yet it serves as a critical mechanism for ensuring that innovations reach patients safely. Moreover, compliance can transform into a competitive advantage, offering credibility to investors and consumers alike. As startups navigate this intricate landscape, understanding the nuances of regulation will be vital to their success.