MIT Alumni Indicted for $25 Million Crypto Heist Using Bots

Two graduates of the prestigious Massachusetts Institute of Technology (MIT) have been indicted for allegedly orchestrating a cryptocurrency heist that reportedly netted them approximately $25 million. The brothers, Anton and James Peraire-Bueno, face serious charges including conspiracy, wire fraud, and money laundering, as outlined in a federal indictment that was made public earlier this month.

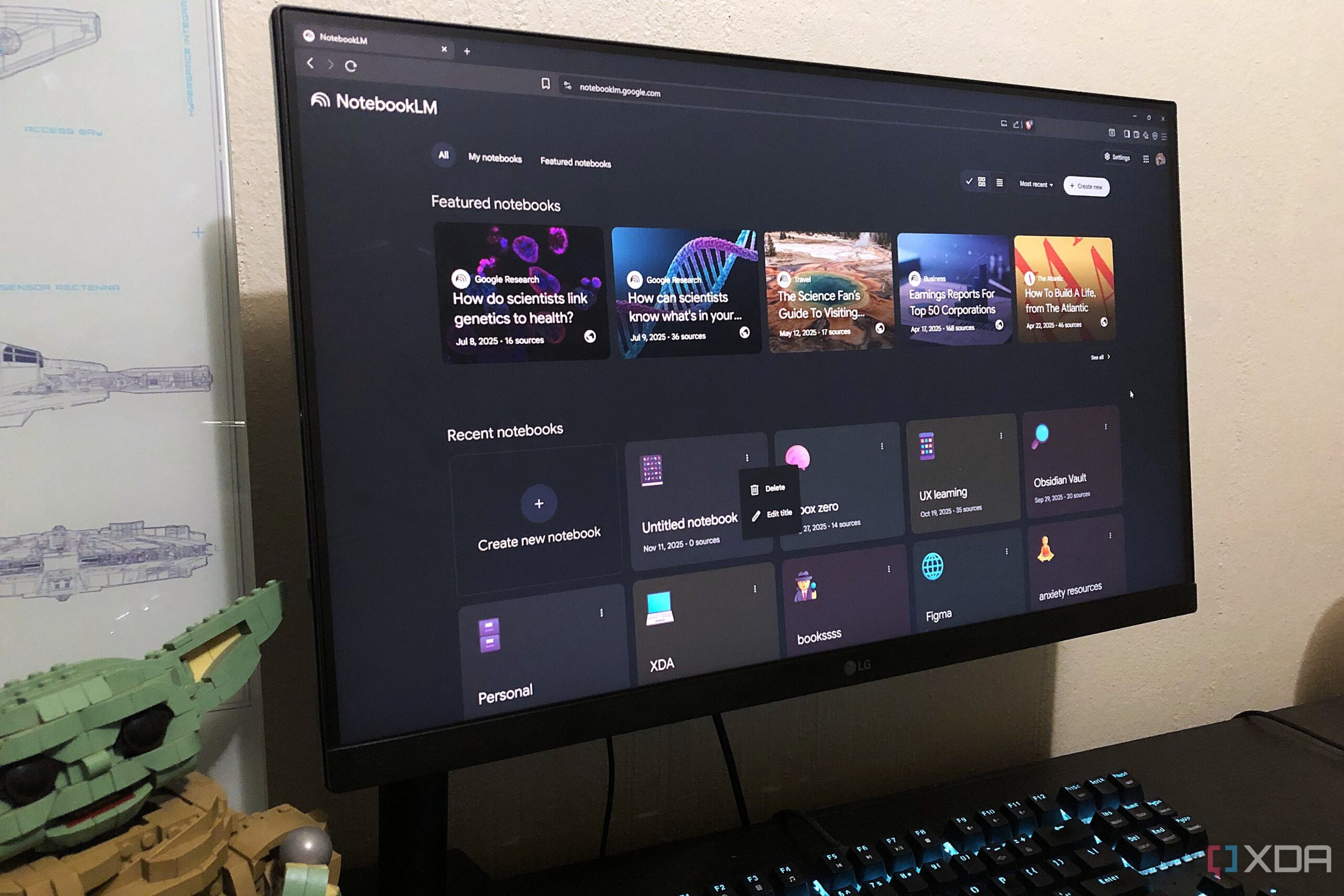

The alleged crime, described by prosecutors as a “first-of-its-kind” financial fraud, involved exploiting automated trading bots within the Ethereum blockchain. According to the federal prosecutor, Ryan Nees, the brothers executed a scheme that allowed them to deceive these bots into engaging in a fraudulent transaction, resulting in a swift theft of funds. “In 12 seconds, the defendants tricked their victims out of $25 million,” Nees stated, emphasizing the rapid and deceptive nature of the operation.

Details of the Alleged Scheme

During the initial phase of the trial, which began this week, prosecutors characterized the brothers’ actions as an “enormous bait-and-switch.” They allegedly took advantage of a software flaw to manipulate the trading environment, enticing crypto bots to invest in what were essentially worthless tokens, referred to as “sh**coins” during the proceedings. Nees highlighted that the brothers even expressed amusement over successfully tricking their victims.

Before executing their plan, the duo reportedly conducted extensive online research, searching for terms such as “how to wash crypto,” “top crypto lawyers,” and “money laundering statute of limitations.” This information suggests a calculated approach to their illicit activities, as they appeared to prepare themselves for potential legal repercussions.

The investigation, which lasted approximately two years, culminated in the brothers’ arrest in May 2023. Authorities revealed that the plot to manipulate transaction validation protocols on the Ethereum blockchain unfolded over several months.

Legal Implications and Defense Arguments

While the prosecution has laid out a compelling case, the defense is positioning their argument around the premise that the Ethereum blockchain operates in an “unregulated market.” Defense attorney Patrick Looby contends that the brothers were merely employing a novel trading strategy within a financial landscape characterized by a lack of centralized oversight. He argued that the absence of government regulations is a fundamental aspect of cryptocurrency’s appeal.

Given the significant financial implications of this case, it is poised to establish crucial legal precedents regarding the U.S. government’s capacity to impose regulations on a cryptocurrency market valued at over $3.5 trillion. As the trial progresses, the outcomes could have far-reaching effects on how similar cases are handled in the future.

The situation highlights ongoing discussions about the complexities of regulating cryptocurrencies and the potential for innovative yet contentious practices within this burgeoning sector. With the trial now underway, the legal ramifications of the Peraire-Bueno brothers’ actions will likely resonate throughout the crypto community and beyond.