Jim Cramer Critiques New Gambling Income Tax as ‘Brutal’

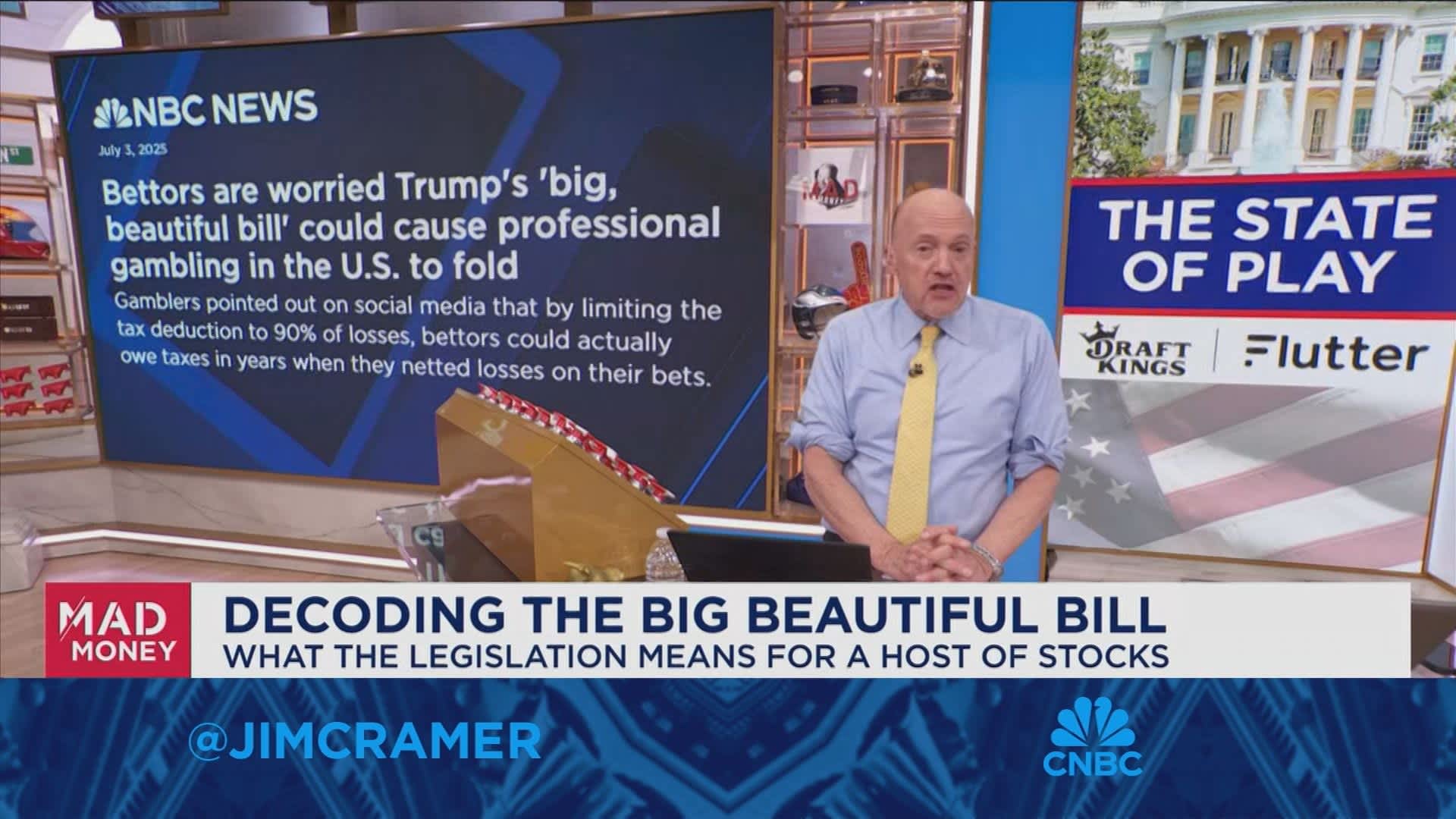

Jim Cramer, the host of CNBC’s Mad Money, has voiced strong opposition to recent changes in taxation for gambling income, labeling the new measures as “brutal.” The alterations, which will impact the way gambling winnings are taxed, have raised concerns about their potential effects on major gambling companies, particularly DraftKings.

Implications for the Gambling Industry

The revised taxation policy, effective from September 2023, shifts the tax burden significantly, imposing higher rates on gambling income. Cramer emphasized that this change could adversely affect investor sentiment and stock performance for companies like DraftKings, which has been a prominent player in the online gaming market.

Cramer elaborated that the new tax structure could lead to decreased consumer spending on gambling activities. As taxes rise, potential gamblers might reconsider their investments in betting, leading to reduced revenues for gambling operators. This could translate into declining stock values, which has investors on edge.

In a broader context, Cramer pointed out that the gambling sector has already faced challenges in the post-pandemic landscape. The introduction of increased taxes may further strain these companies, particularly as they seek to recover from previous losses and regain footing in a competitive market.

Market Reactions and Future Outlook

Market analysts are closely monitoring the situation, with many expressing concern about the long-term ramifications of the tax changes. Cramer noted that investors in DraftKings and similar companies should be prepared for volatility as the market adjusts to the new financial realities.

He urged stakeholders to consider how these tax increases could reshape the gambling landscape. If consumer spending diminishes due to higher taxes, companies might need to adapt their business strategies to maintain profitability. This could involve enhancing customer engagement or exploring new markets to offset potential declines.

As discussions around these tax changes continue, Cramer’s remarks have sparked a wider debate about the future of gambling regulation in the United States. Stakeholders are now assessing how these policies will influence not only corporate performance but also consumer behavior in the gambling sector.

In summary, Jim Cramer’s critical assessment of the new gambling income tax reflects broader concerns within the industry. As the changes take effect, both investors and operators will need to navigate a landscape that could be fundamentally altered by these tax increases.