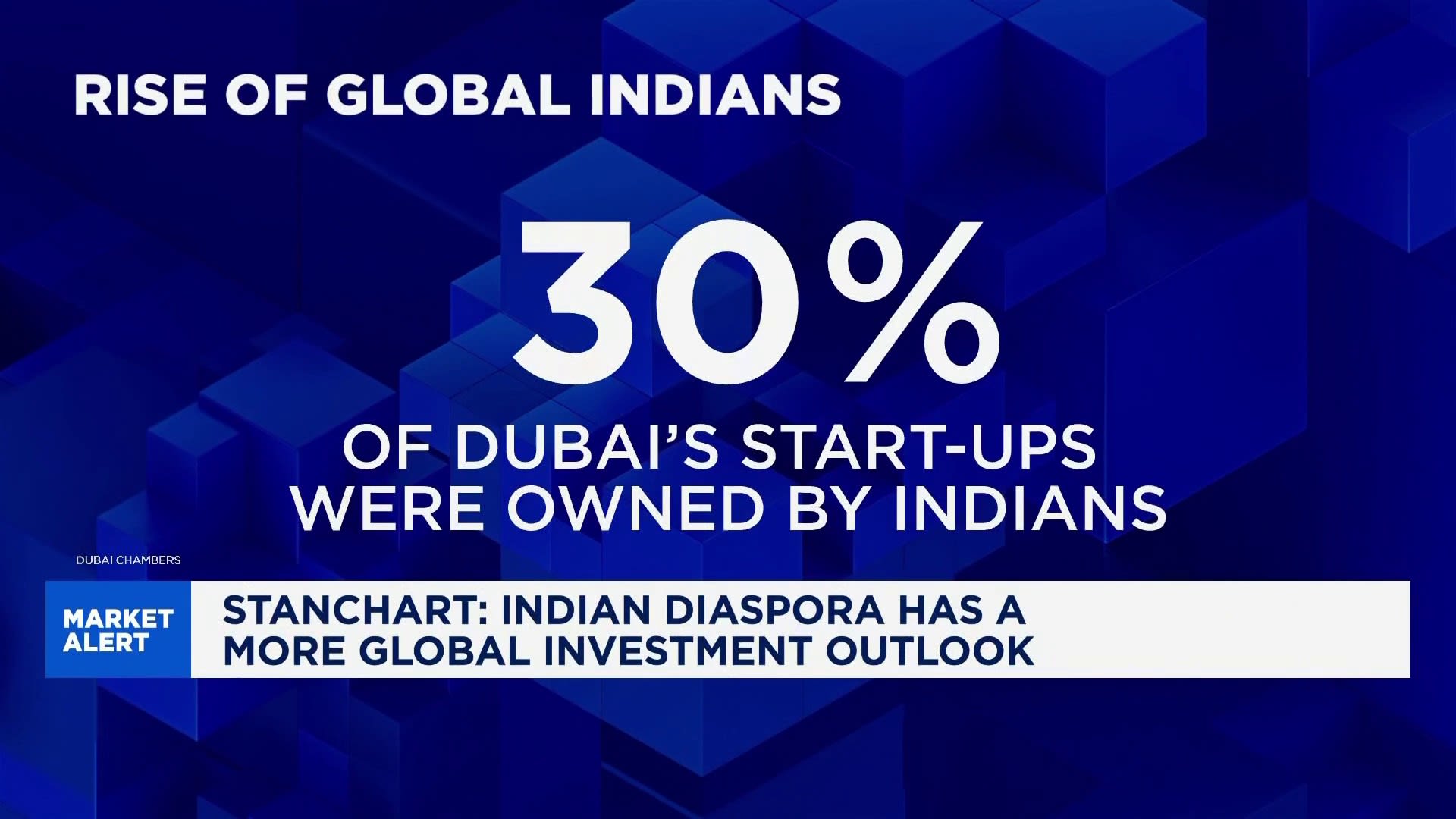

India’s High Net Worth Individuals Shift Investments Amid Economic Changes

High net worth individuals (HNWIs) in India are increasingly diversifying their investment portfolios in response to evolving market conditions. According to a recent report from Morgan Stanley, these investors are moving their capital from traditional assets into sectors like equities and real estate, indicating a strategic shift aimed at long-term growth.

In the past year, the investment landscape for HNWIs has transformed significantly. The Credit Suisse Global Wealth Report indicates that India’s HNWIs, defined as individuals with assets exceeding $1 million, now represent a growing segment of the global wealthy population. As of March 2024, India has seen a substantial increase in the number of individuals fitting this category, further fueling the demand for varied investment opportunities.

Investments in equities have surged, with many HNWIs opting for stocks in technology and renewable energy sectors. The increasing emphasis on sustainability and digital transformation has driven interest in companies that lead these fields. This trend aligns with global market movements, where similar investments have yielded impressive returns.

Real Estate: A Stable Choice

Alongside equities, real estate continues to capture the attention of India’s wealthy investors. The Indian real estate market is witnessing a resurgence, particularly in urban areas, where demand for residential and commercial properties remains strong. Investors are particularly drawn to luxury developments and properties in major metropolitan cities, anticipating robust capital appreciation over the coming years.

In addition to urban real estate, some HNWIs are exploring opportunities in emerging markets within India, where infrastructural development is underway. These investments not only promise potential financial returns but also contribute to the overall economic growth of the regions involved.

As the economic environment evolves, HNWIs are also showing interest in alternative investments. Areas such as private equity, venture capital, and even cryptocurrencies are gaining traction. This diversification reflects a broader trend among wealthy individuals globally, seeking to hedge against market volatility while pursuing higher returns.

Economic experts suggest this shift is a response to both local and global economic factors, including inflationary pressures and changing interest rates. The Reserve Bank of India has indicated that maintaining a balanced approach to investments will be crucial for wealth preservation in the current climate.

The growing sophistication of India’s HNWIs is evident in their investment strategies. Many are increasingly turning to financial advisors and wealth management firms to navigate this complex landscape. By leveraging expert insights, they aim to capitalize on emerging opportunities while mitigating risks associated with market fluctuations.

In summary, India’s high net worth individuals are actively reshaping their investment strategies to align with current economic trends. By focusing on equities, real estate, and alternative assets, they are positioning themselves for sustained growth. As these investment patterns continue to evolve, they will likely play a significant role in the broader financial landscape of India.