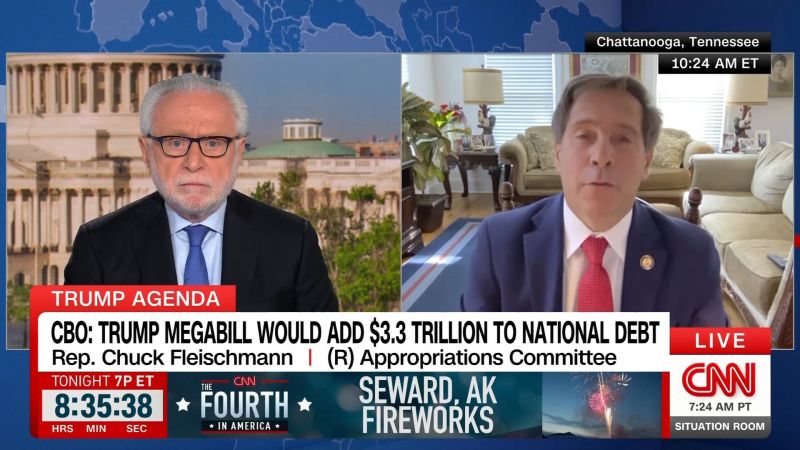

Republican Congressman Chuck Fleischmann has expressed his support for former President Donald Trump’s latest legislative effort, a comprehensive fiscal package dubbed the “big beautiful bill.” Speaking with CNN’s Wolf Blitzer, Fleischmann highlighted the bill as a significant move towards fiscal responsibility, despite potential concerns about its impact on the upcoming midterm elections.

Fleischmann, representing Tennessee’s 3rd District, emphasized that the bill aligns with the GOP’s long-standing commitment to prudent financial management. “This bill is a big step in the right direction,” he stated during the interview. “It addresses critical areas of our economy and sets a foundation for sustainable growth.”

Details of the Fiscal Package

The bill, which has been a subject of intense debate within Congress, aims to overhaul several key economic sectors. It includes provisions for tax reforms, infrastructure spending, and measures to reduce the national deficit. The package is seen as a continuation of Trump-era policies, focusing on boosting economic growth through deregulation and tax cuts.

According to Fleischmann, the fiscal package is designed to stimulate investment and create jobs, particularly in sectors hit hardest by the recent economic downturn. “We need to get Americans back to work, and this bill provides the necessary tools to do just that,” he explained.

Political Implications and Midterm Concerns

The timing of the bill’s introduction has raised questions about its potential impact on the forthcoming midterm elections. Some political analysts suggest that the bill could either bolster Republican support by showcasing legislative achievements or backfire if perceived as favoring corporate interests over individual constituents.

Fleischmann acknowledged these concerns but remained optimistic. “While there are always risks involved, I believe the American people will see the benefits of this legislation,” he noted. “Our focus should be on delivering results that improve lives, not just winning elections.”

Expert Opinions and Historical Context

Economic experts have weighed in on the bill’s potential effects. Dr. Lisa Anderson, an economist at Georgetown University, remarked that while the bill’s tax cuts could spur short-term growth, the long-term implications for the national deficit remain uncertain. “It’s a balancing act,” she said. “The key will be ensuring that growth offsets any increase in debt.”

Historically, similar fiscal policies have had mixed results. The Reagan administration’s tax cuts in the 1980s, for example, led to economic expansion but also contributed to a significant rise in the national debt. The current bill’s success will likely depend on its implementation and the broader economic context.

Looking Ahead

As Congress continues to deliberate on the bill, its future remains uncertain. The legislative process is expected to face hurdles, with opposition from both Democratic lawmakers and some Republicans who are wary of the potential fiscal impact.

Fleischmann, however, remains steadfast in his belief that the bill represents a necessary step forward. “We have a responsibility to act in the best interest of our nation,” he concluded. “This bill is about securing a prosperous future for all Americans.”

The coming months will be critical in determining the bill’s fate and its influence on the political landscape as the midterm elections approach.