Trump Signs Landmark Tax and Spending Bill Amid Controversy

President Donald Trump signed a significant tax and spending cuts bill into law on July 4, 2023, marking a pivotal achievement for his administration. This legislation, which has been met with considerable opposition from Democrats and raised concerns within the Republican Party about its potential impact on the federal deficit and various government programs, aims to reshape the country’s fiscal landscape.

The bill makes permanent the tax cuts initiated in 2017, which were scheduled to expire at the end of the year. It also increases funding for defense, border control, and immigration enforcement. Notably, the legislation enacts substantial reductions to the safety net, particularly affecting Medicaid and food stamp programs.

Key Provisions and Implementation Dates

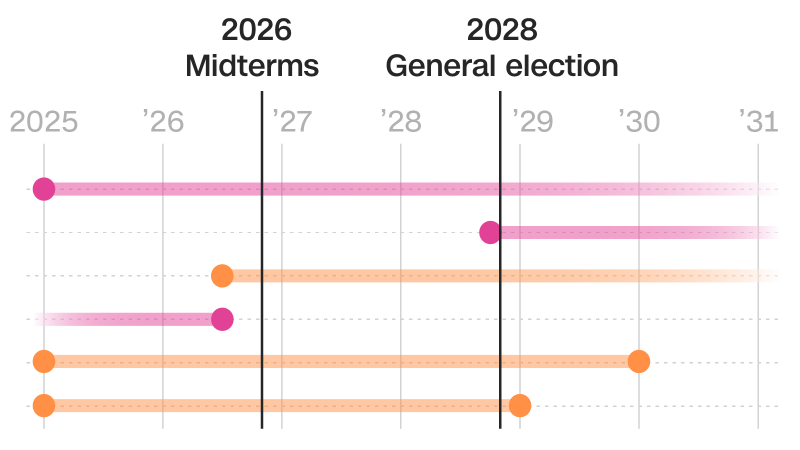

Several provisions of this comprehensive bill will take effect in the near future. For instance, changes to the electric vehicles tax credit and the temporary suspension of taxes on tips and overtime work will be implemented this year. Meanwhile, more significant adjustments, such as those affecting student loans, are slated to commence next year.

A particularly contentious aspect of the bill is a provision that will limit Medicaid eligibility for immigrants. This change is scheduled to be implemented one month before the upcoming midterm elections, further intensifying the political stakes surrounding the legislation.

Looking ahead, critical components of the bill, including new work requirements and increased eligibility checks for Medicaid, are set to be enforced as the nation approaches the 2028 presidential election.

The U.S. Department of Agriculture is expected to provide guidance to states regarding the implementation of these changes, specifically regarding the expansion of work requirements. This includes extending requirements to recipients aged 55 to 64 and parents of children older than 13, along with restrictions on eligibility for certain legal immigrants.

Ongoing Developments and Future Implications

As the timeline for the bill’s provisions unfolds, uncertainty remains around the implementation of two significant modifications to the food stamp program. The Department of Agriculture’s forthcoming memorandum will clarify how states should proceed with these changes.

This landmark legislation not only reflects President Trump’s ambitious policy agenda but also highlights the deep divisions within Congress. The approval from Congressional Republicans underscores the party’s support for Trump’s vision, despite dissent regarding its implications for fiscal responsibility and social welfare programs.

As various provisions begin to take effect, the political ramifications will likely shape the discourse leading up to the midterms and beyond. The evolving landscape of U.S. social and fiscal policy will be closely monitored as stakeholders navigate these significant changes.