Retailers Embrace Co-Branded Credit to Engage Non-Prime Customers

Retailers are increasingly turning to co-branded credit card programs aimed at non-prime consumers as a strategy to enhance customer loyalty. These initiatives offer a pathway for credit inclusion, facilitating improved consumer engagement and enabling individuals to transition to better credit options as their financial situations evolve.

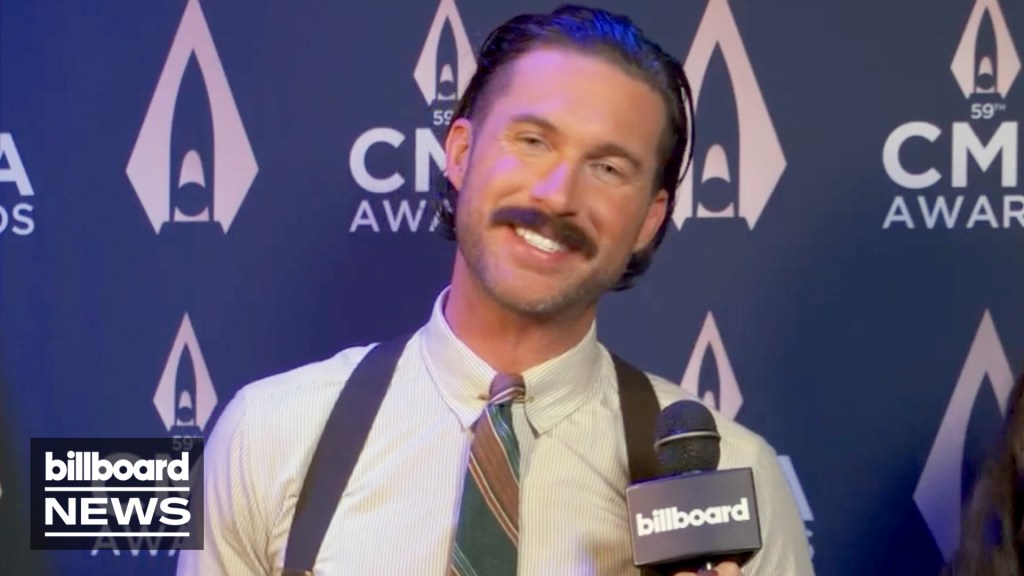

According to Rolando De Gracia, Chief Commercial Officer at Concora Credit, co-branded credit cards serve as a powerful tool for brands to engage customers daily. When consumers use these cards for everyday purchases, such as coffee or travel, they remain connected to the brand. This consistent interaction fosters loyalty, encouraging repeat visits and purchases. “Once someone has that kind of dedicated line of credit… the frequency of visits increases,” De Gracia explained.

The current economic landscape, influenced by the COVID-19 pandemic, has heightened the necessity for adaptive strategies in retail. Many consumers have experienced changes in their credit scores, leading to a form of “credit score inflation.” This shift has resulted in tighter credit conditions as banks have become increasingly cautious. Traditionally, those with less-than-perfect credit have been excluded from loyalty programs, missing out on opportunities to engage with brands.

Recognizing this gap, Concora Credit aims to broaden participation in loyalty programs while preserving their value. De Gracia noted that non-prime consumers typically generate a lower revenue share for issuers, yet they present an opportunity for brand growth. “Any value proposition that you offer to these consumers will be incremental to what they have today,” he said, highlighting the importance of integrating these consumers into existing loyalty ecosystems.

Innovative Approaches to Consumer Engagement

A key element of this strategy is the introduction of a “starter card.” This product is designed for non-prime consumers who may not have access to specific airline or hotel-branded cards, despite frequent interactions with these businesses. The starter card provides an entry point into loyalty programs, allowing consumers to gradually improve their credit profiles.

De Gracia explained that non-prime consumers often see rapid improvements in their credit scores with consistent payments. Unlike prime consumers, whose scores remain relatively stable, non-prime individuals can experience significant gains due to life events that may have previously affected their credit. Approximately 30% of Concora Credit’s cardholders improve their FICO scores sufficiently within six to seven months to qualify for more premium credit offerings.

Concora Credit collaborates with partner banks to identify eligible cardholders whose scores have improved. Once these consumers are recognized as having enhanced their credit profiles, they are often presented with opportunities for better rewards and lower fees. “Once that consumer is eligible for that product, they’ll take it,” De Gracia stated.

Building Strong Partnerships

The graduation strategy not only benefits consumers but also strengthens the relationship between brands and credit issuers. Retailers have reported increases in approval rates at points of sale from 50% to 70% after introducing alternative products in collaboration with Concora Credit. This heightened approval rate boosts confidence among issuers and motivates them to promote these products more vigorously.

“Having someone like us with an alternative non-prime product helps maintain the overall approval rate and the overall engagement for the brand,” De Gracia asserted. This collaborative approach ensures that retailers can sustainably expand into non-prime segments without compromising the value of their loyalty programs.

Through these innovative strategies, retailers are not only enhancing customer loyalty but also paving the way for financial inclusion. By engaging non-prime consumers, brands can improve overall customer experiences and create pathways for financial growth, ultimately benefiting both consumers and businesses in a challenging economic environment.