Metallocene Polyethylene Market Set to Surge to USD 13.30 Billion by 2032

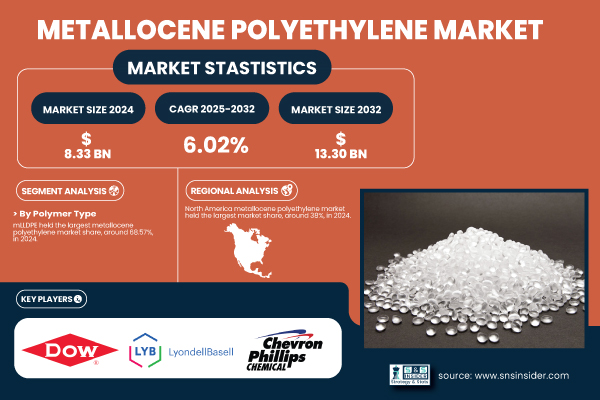

The global Metallocene Polyethylene market is poised for significant growth, projected to increase from a valuation of USD 8.33 billion in 2024 to USD 13.30 billion by 2032. This growth, at a compound annual growth rate (CAGR) of 6.02% from 2025 to 2032, is primarily driven by escalating demand for flexible and sustainable packaging solutions, along with advancements in production technologies.

Metallocene polyethylene is highly regarded for its clarity, toughness, and processability, making it essential for various applications, including packaging, agricultural films, and healthcare products. Recent expansions in production capacity by major industry players such as ExxonMobil and Chevron Phillips Chemical, along with innovative product launches, highlight the ongoing investments in this sector.

Market Dynamics and Regional Insights

The increasing emphasis on sustainability, exemplified by initiatives such as the U.S. Plastics Pact, is reshaping the metallocene polyethylene landscape. The material’s recyclability aligns with evolving consumer preferences and regulatory pressures. In 2023, domestic production in North America surpassed 24 million metric tons, bolstered by a surge in e-commerce packaging demands.

The U.S. market for metallocene polyethylene was valued at USD 2.38 billion in 2024, with expectations to grow to USD 3.85 billion by 2032, achieving a CAGR of 6.21%. This market growth is driven by innovations in high-performance flexible packaging and sustainable agricultural films, supported by substantial investments from companies like Dow, ExxonMobil, and Chemical.

Key Product Segments and Applications

By polymer type, metallocene linear low-density polyethylene (mLLDPE) dominated the market in 2024, holding a market share of 68.57%. mLLDPE is favored for its superior toughness, sealability, and puncture resistance, making it ideal for stretch and shrink films. Innovations such as ExxonMobil’s Exceed XP grades, launched in 2022, have enhanced its strength and efficiency, further boosting market adoption.

The films segment is the largest application area, accounting for 56% of the market share in 2024. This segment’s growth is driven by the rising demand for lightweight, flexible packaging solutions, particularly in the food sector, where convenience and resealability are paramount. Dow’s innovations in 2023 have enabled downgauging by up to 20%, significantly reducing plastic usage while maintaining performance.

In agriculture, multi-layer metallocene films improve UV resistance and crop protection, responding to the increasing needs of sustainable farming practices. The growth of e-commerce has also heightened demand for packaging solutions such as stretch wraps and courier bags, pushing converters and brand owners to invest in high-performance film applications.

The North American region accounted for 38% of the metallocene polyethylene market in 2024, largely due to extensive domestic production capabilities and a commitment to sustainability. Companies like ExxonMobil, Dow, and Chemical have expanded their facilities in Texas and Louisiana to enhance production of high-performance materials.

As regulatory frameworks increasingly focus on recyclability and sustainability, North America is positioned as a key hub for production and innovation within the metallocene polyethylene industry.

Recent advancements include Dow’s launch of new AGILITY CE metallocene grades in March 2024, featuring 70% post-consumer recycled content, further indicating the industry’s commitment to sustainability.

Overall, as technological innovations and consumer preferences continue to evolve, the metallocene polyethylene market is expected to adapt and thrive in the coming years, driven by a combination of sustainability and performance-enhancing advancements.