Government Shutdown Threatens Upcoming Jobs Report Publication

The US government has entered a shutdown following Congress’s failure to pass a spending bill before the midnight deadline on October 4, 2023. As a result, the Bureau of Labor Statistics (BLS) may not release its monthly jobs report scheduled for October 6, which provides critical insight into the labor market. This report is essential for businesses and policymakers, including the Federal Reserve, to gauge economic health and labor demand.

If the shutdown continues into mid-October, it could also disrupt the release of key inflation indicators, including the Consumer Price Index (CPI) and the Producer Price Index (PPI). These reports, crucial for understanding inflation trends, are set for publication on October 15 and October 16, respectively. Typically, the CPI informs the Social Security Administration’s annual cost-of-living adjustment for benefits, which relies on third-quarter inflation data.

In a contingency plan outlined by the Department of Labor, the BLS will “suspend all operations” during the funding lapse. This means that planned publications will be shelved, data collection will cease, and the agency’s website will not be updated. Such a halt could lead to delays in the release of not only the jobs report but also other significant economic indicators.

The implications of the shutdown echo those experienced during previous federal funding lapses. For instance, during the 2013 government shutdown, the September jobs report was delayed by approximately two weeks. Similarly, the longest shutdown, which occurred from late 2018 to early 2019, saw no interruption in data collection as the BLS remained funded.

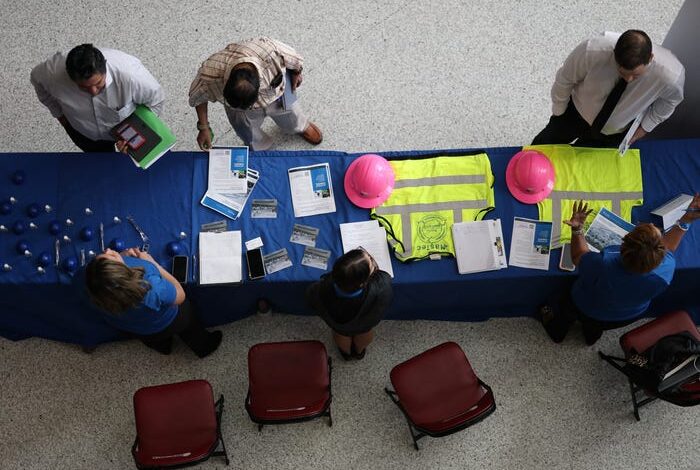

Job seekers rely heavily on the jobs report to assess labor demand, competition for job opportunities, and wage trends. Recent reports have indicated job growth falling short of expectations, with a slight uptick in unemployment despite overall low rates. The report’s absence could hinder job seekers’ ability to navigate the current labor landscape effectively.

The potential postponement of the CPI and PPI releases would have broader economic implications. Gregory Daco, chief economist at EY, noted that each week of the shutdown could decrease fourth-quarter GDP growth by 0.1 percentage points (annualized), amounting to approximately $7 billion in economic activity per week. This drop results mainly from lost wages, procurement delays, and reduced consumer demand.

José Torres, a senior economist at Interactive Brokers, highlighted that “an extended halt” could dampen both consumer spending and employment levels. The long-term effects on market confidence could exceed the immediate economic impacts.

As the government shutdown continues, the economic landscape remains uncertain. The anticipated jobs report and inflation indicators are vital for understanding and responding to the evolving economic conditions. The coming days will be pivotal, as the government’s actions will determine how long these essential reports remain unavailable.