FX Option Expiries Impact EUR/USD and USD/JPY on August 27

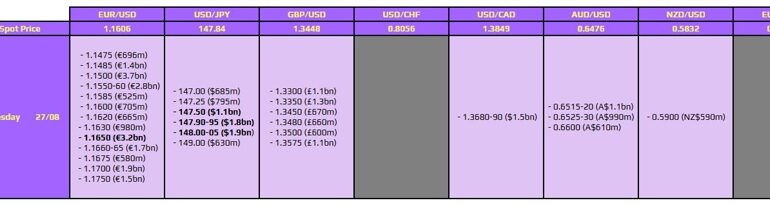

Foreign exchange option expiries on August 27 at 10:00 AM New York time are expected to influence trading dynamics, particularly for the EUR/USD and USD/JPY currency pairs. Traders should pay close attention to specific levels that could affect price action throughout the session.

EUR/USD Resistance Level and Market Dynamics

The EUR/USD pair is currently positioned around the 1.1650 level, but recent market trends show the dollar maintaining strength. As a result, the expiries above this level are unlikely to play a significant role today. Notably, there is a concentration of activity near key hourly moving averages between 1.1646 and 1.1657. This range may act as a resistance layer, potentially hindering any unexpected upward movements in the pair during trading.

USD/JPY Trading Range and Expiry Influence

For the USD/JPY pair, option expiries are positioned at 147.50 and clustered around the 148.00 mark. The concentration of interest at these levels is expected to keep price action contained, as they are close to critical psychological levels. Following a drop on August 1, market sentiment has shifted back towards a bullish outlook for USD/JPY. However, since then, the pair has primarily consolidated within a range of 146.50 to 148.30. This range is likely to continue influencing market behavior as traders react to the expiries.

While some technical issues have arisen with the data source, which may delay the availability of specific expiry details, it’s anticipated that these concerns will be resolved shortly. Traders seeking to utilize this data can refer to resources available on investingLive, a platform formerly known as ForexLive, for further insights.

In conclusion, understanding the impact of these expiries on the EUR/USD and USD/JPY pairs can be crucial for traders navigating the foreign exchange market. With the current dynamics, traders should remain alert to potential shifts in pricing as the session progresses.