Cramer Advises Investors to Dismiss Apple Downgrade by Jefferies

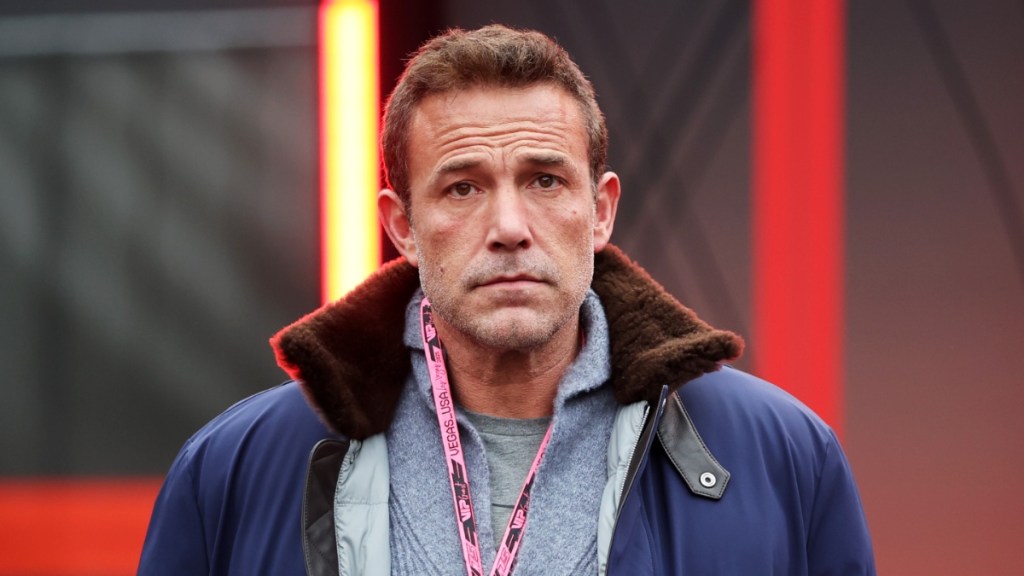

Jim Cramer, the well-known financial commentator, urged retail investors on October 6, 2023, to disregard a recent downgrade of Apple Inc. shares by investment firm Jefferies. The downgrade, which shifted Apple’s rating from “hold” to “underperform,” prompted Cramer’s strong reaction during his segment on CNBC.

Cramer, addressing his audience directly, stated, “People at home, I urge you not to listen.” His comments reflect a broader sentiment among many analysts who believe that the long-term prospects for Apple remain robust, despite short-term fluctuations in stock performance.

While Jefferies expressed concerns about factors such as lower demand for the iPhone, Cramer emphasized the importance of looking at Apple’s overall business strategy and its substantial market presence. He pointed out that Apple has consistently demonstrated resilience and adaptability in the face of market challenges.

Investors often react strongly to analyst ratings, and Cramer’s intervention highlights the ongoing debate about the reliability of such assessments. He encouraged viewers to maintain a broader perspective, reminding them that stock prices can be influenced by a myriad of factors beyond immediate sales numbers.

This incident underlines the volatility inherent in the technology sector, where companies like Apple face intense scrutiny. The company’s performance is often closely tied to consumer trends and innovations, which can lead to rapid changes in investor sentiment.

Many investors are familiar with the cyclical nature of tech stocks, and Cramer’s advice serves as a reminder to exercise caution. He underscored that while it is essential to pay attention to market signals, it is equally important to consider long-term growth potential.

Investors will be watching closely as Apple prepares for its upcoming product launches, which could influence market perceptions and stock performance in the coming months. Cramer’s comments resonate as a call for investors to focus on the bigger picture rather than reacting impulsively to analyst downgrades.

In conclusion, Cramer’s appeal to disregard the Jefferies downgrade serves as an important reminder that individual assessments should be weighed against comprehensive analyses of a company’s fundamentals. As the landscape of the technology market continues to evolve, investors must navigate these complexities with informed judgment.