Financial Markets React to Trump’s Tariff Deadline Extension

Financial markets experienced volatility this week as President Donald Trump extended a critical 90-day deadline for significant trade deals. This announcement follows the imposition of unilateral tariffs on numerous U.S. trading partners, a move first enacted in April 2018. As a result, investors are closely monitoring the evolving landscape of U.S. trade policy, which appears to be in constant flux.

The extension of the deadline has created uncertainty among investors. Many had anticipated a resolution to the ongoing trade tensions, particularly with major economies like China and the European Union. Instead, Trump’s decision to prolong negotiations has led to a range of reactions in the markets, contributing to a lack of confidence in future trade agreements.

Market analysts indicate that the extension could reflect the administration’s struggle to balance domestic economic pressures with international trade relations. According to a report from the International Monetary Fund, the ongoing tariffs have already impacted global supply chains and increased costs for American consumers. The IMF has projected that the U.S. economy could face a slowdown if these trade disputes remain unresolved.

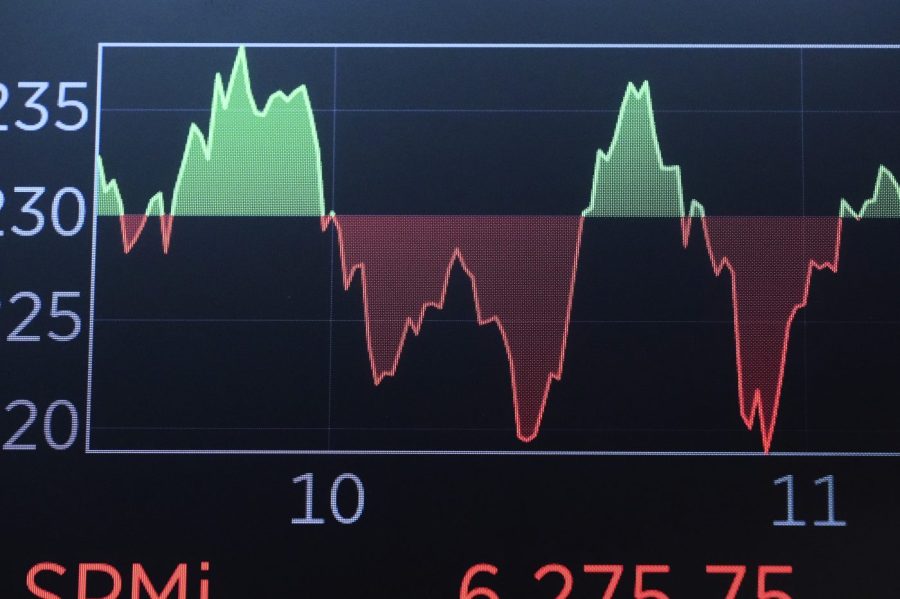

Investor sentiment has shifted, with many expressing concern over potential economic repercussions. Analysts suggest that uncertainty surrounding tariffs may hinder business investment and consumer spending, which are vital components of economic growth. The S&P 500 index and other major indices have shown signs of instability, with fluctuations reflecting investor apprehension over the evolving trade policy.

Furthermore, Trump’s administration has been under pressure from various sectors, including agriculture and manufacturing, which have been adversely affected by tariffs. Farmers, in particular, have raised alarms about retaliatory measures imposed by trading partners, leading to significant losses in certain markets. This ongoing strain has prompted calls for clarity from the White House regarding future trade negotiations.

As investors digest this latest development, the focus remains on how the administration plans to navigate the complex web of international trade relations. The stakes are high, as the outcome of these negotiations could have profound implications for the U.S. economy and its position in the global market.

In conclusion, the extension of the trade deadline by President Trump has left financial markets in a state of uncertainty. Investors are keenly aware that the evolving policies could lead to significant changes in the economic landscape, making it imperative to stay informed on future developments. As the situation unfolds, market participants will continue to monitor the administration’s actions closely, hoping for a resolution that fosters stability and growth.