LG Display’s Strategic Moves Signal a Potential Turnaround in OLED Market

LG Display (LGD) has been navigating turbulent financial waters, having closed its fourth consecutive year of losses. However, a series of strategic maneuvers in early 2024 has sparked new hope for the beleaguered company. Despite carrying approximately $10 billion in negative assets, LGD has managed to secure a $1.2 billion deal with TCL for the sale of its under-utilized Gen 8.5 LCD fab in Guangzhou. This transaction marks a significant shift in LGD’s fortunes.

Simultaneously, LGD has gained an increased share in the iPhone panel supply chain as BOE failed to qualify for the top four iPhone 17 models. Additionally, Apple has slowed its conversion of iPads and MacBooks to OLED screens, having overestimated the market size for the iPad Pro OLED by a factor of two. These developments have provided LGD with crucial capital and time to address the OLED IT market, offering a much-needed lifeline.

Strategic Innovations and Market Adaptations

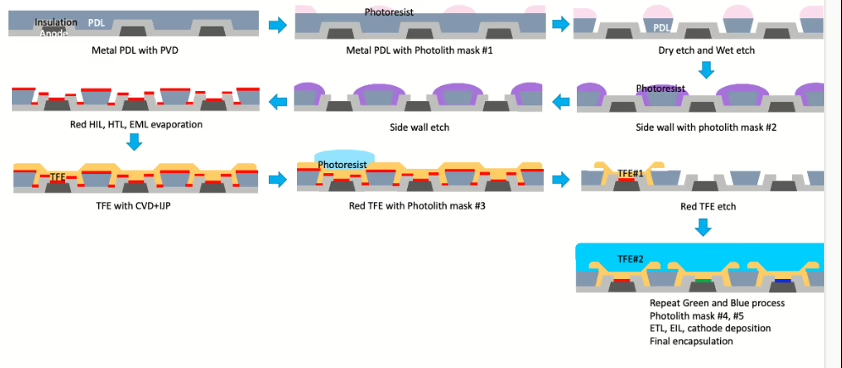

In response to these opportunities, LGD has devised a plan to repurpose its excess Gen 8.5 capacity. This strategy allows the company to avoid the costly replication of Canon/Tokki’s fine metal mask (FMM) and vacuum thermal evaporation (VTE) tools required for hybrid OLED manufacturing. Instead, LGD is exploring Japan Display Inc.’s (JDI) eLEAP technology, which employs photolithographic patterning similar to Visionox’s ViP system, utilizing Applied Materials’ Max OLED tool.

Although full details remain under wraps, LGD is expected to convert some of its Gen 8.5 capacity in Paju into an oxide backplane. This move could align with JDI’s unoccupied half Gen 5 eLEAP pilot line or involve purchasing a pilot tool from Applied Materials, as Samsung Display (SDC) has done. By eliminating FMMs and FMM-VTE equipment, LGD could achieve a larger OLED aperture ratio, enhancing brightness, efficiency, and lifespan while reducing pixel crosstalk through more precise patterning.

Applied Materials, JDI, and Visionox claim significant performance improvements with these technologies, asserting that the Max OLED tool is versatile enough for all display applications, from micro OLEDs to large-screen televisions.

Market Dynamics and Competitive Landscape

The OLED market has been in flux since Apple’s 2023 announcement to convert iPads and MacBooks to OLED displays, following its earlier adoption for iPhones. This announcement spurred a rush among OLED manufacturers to capture a share of the burgeoning market. While SDC, BOE, and Visionox began funding new Gen 8.6 and Gen 7 fabs, LGD, JDI, and CSOT lagged due to limited capital and commitment.

Currently, Apple sources hybrid OLED panels from both SDC and LGD for the iPad Pro, with a second OLED iPad expected in 2025 and an OLED MacBook anticipated in 2026. These devices will likely feature displays manufactured at Samsung’s new Gen 8.6 OLED fab. The diversity in manufacturing methods—FMM versus photopatterning—raises questions about Apple’s willingness to accept OLED panels with differing production techniques for its IT devices.

Expert Insights and Future Prospects

Barry Young, a prominent figure in the display industry since 1997 and managing director of the OLED Association, offers valuable insights into these developments. Young has played a significant role in shaping the OLED landscape, promoting the technology’s advancement and market penetration.

As LGD continues to adapt and innovate, the future OLED Gen 8.x supply chain could see significant changes. The role of panel makers is critical, with each pulling in different directions, yet Apple remains at the helm, guiding the industry with its strategic decisions.

If LGD’s plans succeed, the company could redefine its position in the OLED market, potentially influencing the supply chain dynamics and competitive landscape. The coming years will be pivotal as LGD and its competitors strive to meet the evolving demands of technology giants like Apple.