Fidelity Reveals Top AI Stocks as Spending Surges to $300B

UPDATE: Fidelity Investments has just announced its top AI stock picks as the industry braces for a staggering increase in spending, projected to surge from $100 billion in 2023 to over $300 billion by 2025. This AI revolution is not just a tech trend; it is reshaping IT budgets and driving investment across major companies, creating a sense of urgency in the market.

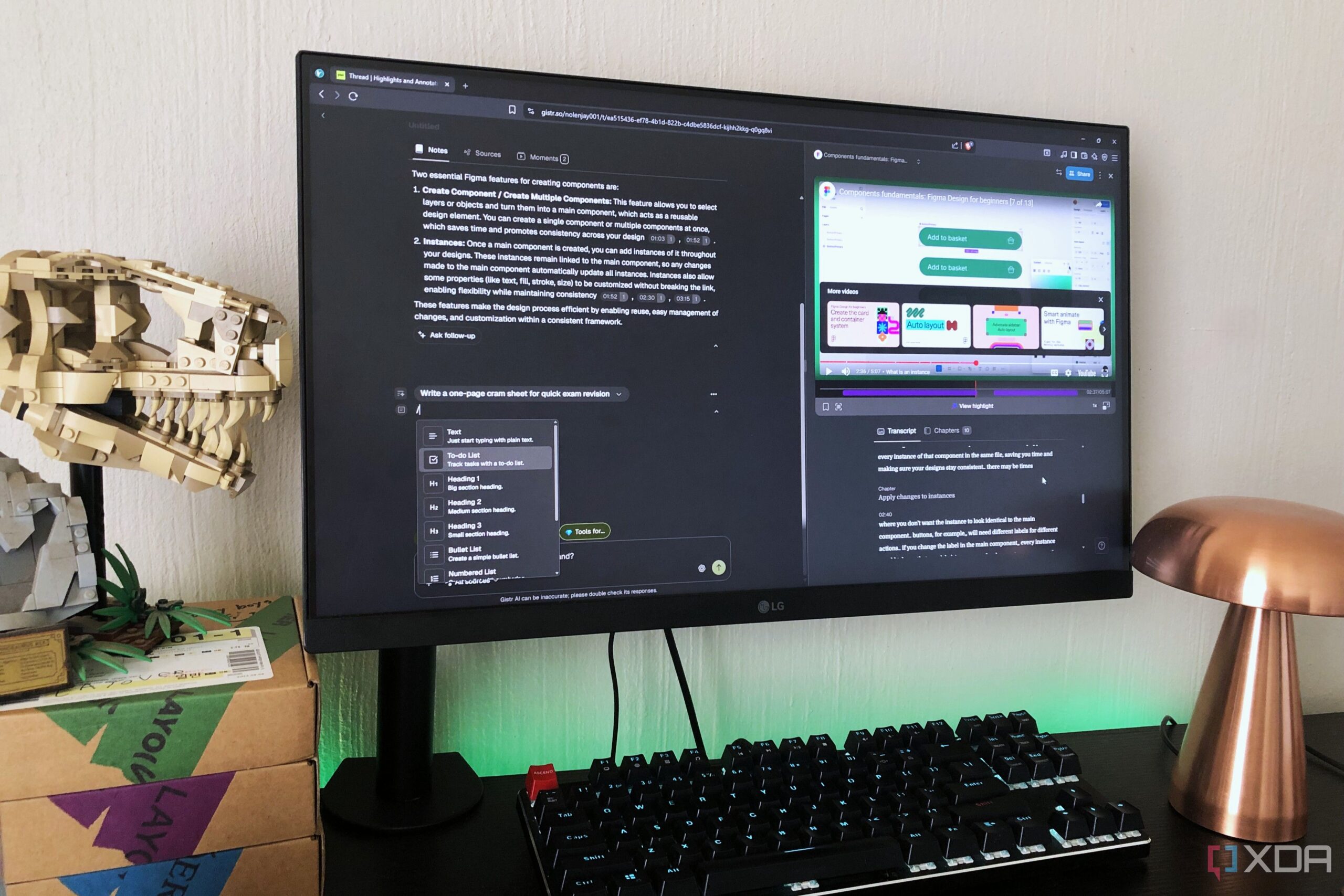

The demand for AI technologies, particularly in cloud computing and data centers, is unprecedented, reminiscent of the Internet boom. Major tech players including Amazon, Microsoft, Google, and Meta Platforms are racing to upgrade their infrastructure, investing heavily in next-generation chips specifically designed to handle AI workloads.

Fidelity’s analysis highlights how these investments could potentially yield significant profitability, with large funds increasingly backing AI stocks. The firm, which manages $5.9 trillion in assets, emphasizes that AI is not just a passing phase—it’s a fundamental shift in technology.

Fidelity portfolio manager Priyanshu Bakshi believes that despite skepticism about the sustainability of such high spending, major tech stocks are beginning to deliver impressive results. “The members of the ‘magnificent seven’—NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla—are achieving earnings growth in the mid-20% range, far outpacing the mid-single-digit growth of the rest of the S&P 500,” he stated.

Fidelity’s findings reveal that Alphabet and Meta dominate Bakshi’s portfolio, making up nearly 50% of the Fidelity Select Communication Services Portfolio. With combined digital ad sales exceeding $500 billion, these companies are already leveraging AI to enhance advertising relevance, which could further boost their future growth.

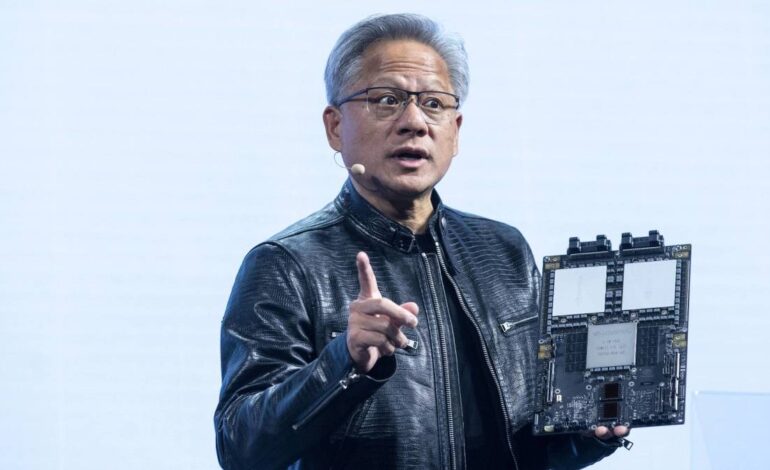

As the AI spending wave continues, Nvidia stands out with sales skyrocketing from $27 billion in 2022 to $187 billion over the past year. The company’s GPUs are integral to AI processing, making them the industry standard. Their next-gen AI chips, expected in 2026, are anticipated to revolutionize the market even further.

While Nvidia leads the charge, other chipmakers are also gaining traction as demand for custom processors increases. Fidelity’s Adam Benjamin points out that “Nvidia isn’t just a chip company anymore; they’re selling complete systems designed for AI.” Companies like Broadcom and Marvell Technology are also benefiting from this AI buildout, which is creating new opportunities in server technology.

But as AI applications expand, so does the strain on power grids. Fidelity co-manager Clayton Pfannenstiel warns that powering massive data centers is a growing challenge. He advocates for natural gas turbines as an immediate solution to the power bottleneck, noting increased orders that are driving earnings guidance higher for related companies.

With companies like GE Vernova and Eaton positioned to capitalize on this surge, the AI boom is not just about tech—it’s a multi-faceted economic event impacting energy, infrastructure, and beyond.

“The AI industry is still in its infancy,” Pfannenstiel declared. “Many ‘picks and shovels’ companies are going to benefit as this market grows.”

Investors are closely monitoring these developments, weighing the potential for an AI-driven economic transformation against concerns of a market bubble. However, Fidelity’s Director of Global Macro Jurrien Timmer reassures that the current valuation environment is not reminiscent of past bubbles. Unlike the debt-fueled Internet boom, today’s AI investments are primarily cash-funded by profitable companies.

As AI continues to evolve, Fidelity’s insights are pivotal for investors eager to understand the landscape of this rapidly expanding market. The next few years could redefine the technology sector, making it essential for stakeholders to stay informed about these crucial developments. Share this urgent news to keep your network updated on the future of AI investments!