TSMC Announces Urgent Price Hikes, Threatens iPhone 18 Pricing

UPDATE: TSMC has just informed major clients, including Apple Inc., of imminent price increases that could significantly impact the upcoming iPhone 18 lineup. As the tech giant gears up for its 2026 release, the rising costs of advanced chip production threaten to break Apple’s long-standing no-price-hike strategy.

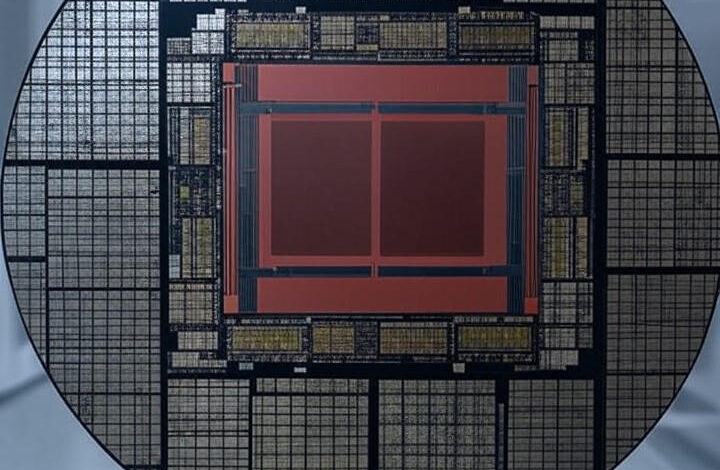

According to a recent report from MacRumors, TSMC’s price hikes are driven by escalating manufacturing costs for its cutting-edge 2-nanometer chips. The pressure is mounting as TSMC prepares to implement these increases starting as early as 2026, impacting Apple’s ability to maintain competitive pricing.

The transition to 2nm technology represents a major leap in performance and efficiency, but it comes at a steep cost. User Dan Nystedt reported on X that the production of the A20 chip for the iPhone 18 could reach an eye-popping $280 per wafer, a drastic increase from the A18’s $45 price tag. The anticipated manufacturing costs for 2nm chips are projected to be 50% higher than current levels, according to analyses by AppleInsider.

This price surge is part of a broader trend affecting the tech industry. TSMC is expected to raise prices by 8-10% for current chips, including the A16 through A19 and M-series processors, impacting not only Apple but also competitors like Nvidia in the AI chip market. These adjustments could lead to more expensive smartphones and laptops as costs are likely passed on to consumers.

Apple has historically maintained stable pricing for its iPhones, often absorbing cost increases to keep entry-level models affordable. However, with TSMC’s impending price hikes, the company faces a pivotal moment. Wccftech has highlighted that the combination of rising costs and the pressure to sustain quality could lead to noticeable price increases for future iPhones.

The implications of TSMC’s decisions extend beyond Apple’s immediate concerns. The semiconductor giant’s adjustments could lead to a 3-5% rise for sub-5nm chips, impacting various tech companies reliant on TSMC’s advanced manufacturing capabilities. Analysts warn that this could significantly strain profit margins for Apple, which sources all its A-series and M-series chips exclusively from TSMC.

The financial repercussions could ripple through the consumer market. With the anticipated launch of the iPhone 18, analysts are already cautioning that consumers may soon see a departure from Apple’s no-price-hike policy, predicting higher costs for both iPhones and Macs.

As Apple considers its options, rumors suggest a staggered launch for the iPhone 18. Reports indicate that Apple may debut the Pro models first in September 2026, delaying the base model by six months. This strategy could help mitigate costs and encourage customers to opt for higher-end devices.

The situation remains fluid as TSMC ramps up for 2nm production. As the tech industry braces for new pricing realities, consumers and investors are closely monitoring how Apple will navigate these challenges. With multiple sources, including Yahoo Finance and Moneycontrol, confirming the potential for significant price hikes, the tech giant’s ability to balance innovation with affordability is under intense scrutiny.

As the semiconductor landscape evolves, the stakes are higher than ever. The future of consumer electronics rests on the interplay between TSMC’s pricing power and Apple’s market strategies. The next couple of years will be crucial in determining how these developments will reshape the tech market and consumer choices.