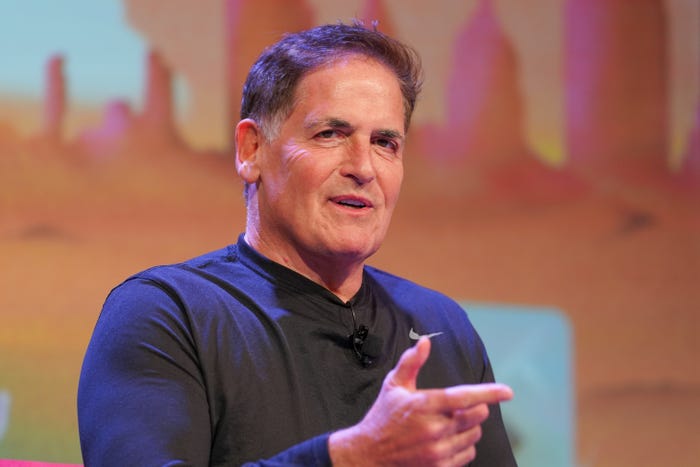

Mark Cuban Urges Companies to Share Wealth with Workers NOW

BREAKING: Mark Cuban has just announced a bold call for companies to share wealth with employees, advocating for stock options to be extended beyond CEOs. Speaking on X, Cuban emphasized that “compassion and capitalism, not greed,” can elevate the nation’s workforce.

Cuban’s comments come in response to growing criticism over the widening wealth gap between executives and average workers. He argues that as billionaire wealth soars, it is essential to ensure employees benefit proportionately from their companies’ successes.

“You know who is funding the increase, particularly lately? Retail investors. 401ks,” Cuban stated, referencing the role of everyday investors in the stock market surge. He posed a critical question: “Why are we not giving incentives to require companies to distribute shares to all employees at the same percentage of cash earnings as the CEO?”

The urgency of Cuban’s message is underscored by alarming statistics from the American Federation of Labor and Congress of Industrial Organizations, which revealed that S&P 500 CEOs earned an astonishing 268 times more than the median worker in 2023.

Cuban’s commitment to employee equity is not new. He has long advocated for employee stock options as a means to enhance loyalty and productivity. In a previous appearance on the “This is Working” podcast, he stated that businesses must share equity with workers to emerge stronger post-COVID-19. “You will get more from your employees, and they will be more committed if you share equity immediately in a meaningful way,” he affirmed.

Reflecting on his own experiences, Cuban revealed that when he sold his streaming company Broadcast.com to Yahoo for $5.7 billion, 300 out of 330 employees became millionaires. He emphasized that in every business he sold, he distributed bonuses to employees who had been with him for over a year.

In a recent X post, he highlighted his philosophy: “Successful entrepreneurs derive less satisfaction from money once your LIQUID net worth becomes high enough.” He believes that true fulfillment comes from using one’s business acumen to uplift others.

As this discussion gains traction, attention is also on proposals like Tesla’s ambitious $1 trillion pay package for CEO Elon Musk, contingent on raising the company’s market cap to $8.5 trillion by 2035. Such plans have reignited debates about executive compensation and the need for more equitable pay structures.

With this urgent call to action, Cuban is challenging companies to rethink their reward systems and consider the long-term benefits of shared success. The implications of his advocacy could reshape corporate America, making it a crucial moment for companies to address employee compensation.

As the conversation evolves, stakeholders across industries will be watching closely. Will more companies heed Cuban’s call for equity? The future of corporate compensation may depend on it.