UiPath Inc Sees Stock Surge, But P/E Ratio Signals Caution

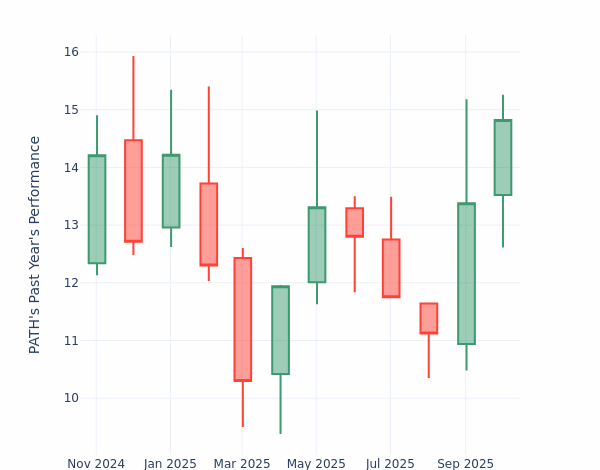

UiPath Inc. (NYSE:PATH) experienced a notable rise in its stock price, trading at $14.79 following a 1.86% increase in the current session. Over the past month, the stock has surged by 24.54%, while its annual growth stands at 19.13%. This positive momentum has sparked optimism among long-term shareholders, although some investors are examining the company’s price-to-earnings (P/E) ratio to assess its valuation.

Evaluating UiPath’s P/E Ratio

The P/E ratio serves as a critical tool for investors to evaluate a company’s market performance relative to its earnings and the broader industry. A lower P/E ratio might indicate that shareholders expect limited future performance or suggest that the company is undervalued. In the case of UiPath, the P/E ratio is currently at 484.0, significantly higher than the software industry average of 77.56.

This disparity suggests that while investors may be optimistic about UiPath’s potential for future growth, there is a strong possibility that the stock is overvalued. Such a high P/E ratio could imply inflated expectations that may not materialize, leading to caution among potential investors.

Understanding the Implications of the P/E Ratio

While the P/E ratio is an important metric for assessing a company’s financial health, it is essential for investors to approach it with caution. A low P/E can indicate undervaluation, but it might also reflect weak growth prospects or financial instability. Therefore, it is critical to incorporate other financial ratios, industry trends, and qualitative factors into the investment analysis.

By adopting a comprehensive approach to evaluating a company’s performance, investors can make informed decisions that enhance their chances of achieving successful investment outcomes. As the financial landscape continues to evolve, careful scrutiny of metrics like the P/E ratio will remain vital for those looking to navigate the complexities of the market effectively.

In conclusion, while UiPath’s recent stock performance has captured attention, the high P/E ratio warrants careful consideration. Investors should weigh this metric alongside other indicators to ensure a balanced perspective on the company’s potential for future growth.