Wall Street Hits New Records as Tesla Stock Soars Amid Fed Speculation

UPDATE: Wall Street has surged to new heights, with the S&P 500 climbing 0.5% to set another record, just hours ago. The Dow Jones Industrial Average added 0.1%, while the Nasdaq Composite jumped 0.9% to reach its own all-time high.

The catalyst behind this rally? Elon Musk’s recent investment in Tesla, where he purchased over 2.5 million shares valued at approximately $1 billion. This bold move underscores Musk’s confidence in the electric vehicle giant, pushing Tesla’s stock up by 3.6% today.

Traders are eagerly awaiting the Federal Reserve’s meeting on Wednesday, where it is expected to announce its first interest rate cut of the year. This decision could significantly impact market dynamics, especially if further cuts are hinted at.

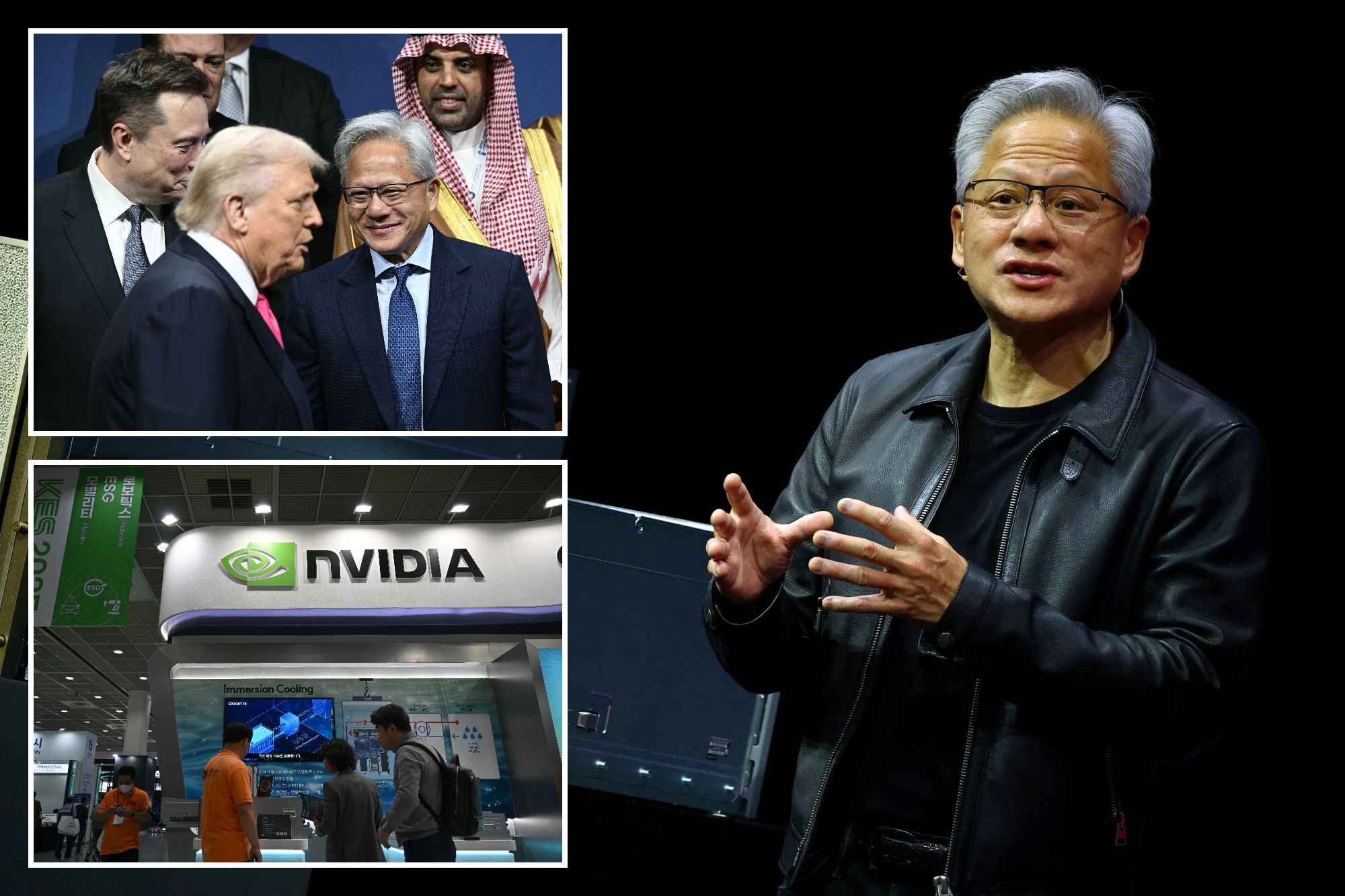

Meanwhile, in a developing story, Nvidia faces scrutiny as Chinese regulators confirmed a preliminary investigation into alleged violations of anti-monopoly laws. The State Administration for Market Regulation has indicated that this investigation could complicate U.S.-China trade talks, which are set to take place in Spain this week.

In another pivotal update, a framework deal has reportedly been reached regarding the ownership of TikTok. U.S. Treasury Secretary Scott Bessent announced after trade discussions that a call between U.S. President Donald Trump and Chinese Premier Xi Jinping may finalize the transition of ownership from China’s ByteDance to U.S. hands.

In environmental news, nearly 200 shipping companies are advocating for the adoption of a global fee on greenhouse gases to mitigate emissions. The Getting to Zero Coalition is pressing for support from major maritime nations ahead of a crucial meeting next month in London. However, the proposal faces opposition from the Trump administration, setting the stage for a significant debate on climate action.

As the Fed grapples with economic uncertainty and political pressure, it remains to be seen how these developments will shape its upcoming decisions. Investor sentiment is tense, with expectations of a quarter-point rate cut to around 4.1%.

On a lighter note, the Boys & Girls Clubs of America are seeing a surge in donations following a controversial fundraising stunt at the Emmys by host Nate Bargatze. The organization has raised $250,000 due to this event, which has doubled their typical donation totals.

Stay tuned as we continue to monitor these rapidly unfolding stories and their implications for the markets and beyond.