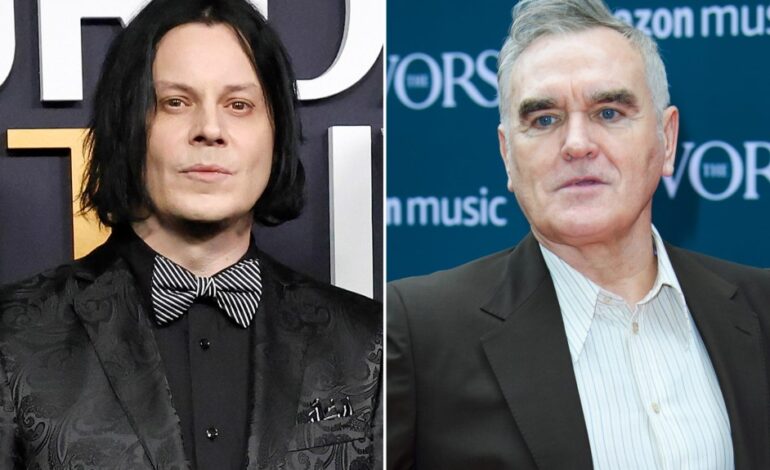

Jack White Sells Copyright Stake as Morrissey Seeks Buyers

In a notable shift within the music industry, Jack White has sold a stake in his copyrights to Sony Music Group, while Morrissey has set his sights on selling his own music assets. This development highlights the differing valuations of two iconic catalogs in the alternative rock scene.

As reported by Luminate data, White’s various musical endeavors generate enough commercial activity to rival The Smiths’ catalog. However, he is poised to secure a more substantial financial return than Morrissey, even if the latter successfully sells his music. A key factor is that White retains ownership of his master recordings, whereas The Smiths’ masters are controlled by Warner Music Group, which purchased them from the band’s original label, Rough Trade.

From 2022 to 2024, The Smiths averaged 471,000 album consumption units annually in the U.S., outpacing White’s The White Stripes, which saw 302,000 units per year. When combining sales from White’s solo work and other projects, including 128,000 units for his solo catalog, 48,000 for The Raconteurs, and over 8,000 for The Dead Weather, the total reaches an average of 486,000 units annually, slightly surpassing The Smiths.

Despite this, The Smiths maintain a significant advantage in global on-demand streaming, with an annual average of 1.43 billion plays over the last three years compared to White’s total of 1.1 billion. White, however, benefits from a stronger vinyl presence, where each sale significantly enhances his earnings, balancing out the revenue disparity from streaming.

According to estimates from Billboard, both White’s and The Smiths’ recorded catalogs generated approximately $11 million to $12 million annually between 2022 and 2024. Furthermore, each catalog reportedly earned around $4 million in total publishing royalties annually during this period, based on industry standards for licensing revenue.

White’s ownership structure significantly influences his earnings. He retains either complete or partial ownership of his recordings, which allows him to earn up to 80% of revenue after distribution and marketing expenses. In contrast, Morrissey, as a member of The Smiths, likely receives only a fraction of the royalties, estimated at around 4.25% of total revenue due to the contractual norms of the 1980s and 1990s.

Morrissey’s potential payday may come primarily from publishing rights, as he co-wrote all of The Smiths’ songs. If he shares ownership with guitarist Johnny Marr, each would receive 50% of the revenue after administrative fees. However, Morrissey seeks more than just publishing and recorded masters income. His recent announcement titled “A Soul For Sale” indicates he intends to sell “all of his business interests in The Smiths,” including exclusive rights to the band’s name, artwork, and merchandising rights.

Morrissey expressed that he wants a clean break from his former bandmates, citing burnout from unwanted business communications. Unfortunately, a listed email address for inquiries appears to be inactive, leaving him unreachable for further comments.

As for White, he has sold an undisclosed stake in his catalogs to Sony, a logical partner given its history with his recordings. His catalog was previously shopped around with an aim to retain a significant stake, ultimately leading to a split rights deal that allows him to continue promoting his music while securing an immediate financial return. Michael Poster, chair of music acquisition and financing at Michelman & Robinson, explained that such deals align the interests of sellers and buyers, fostering collaboration to enhance catalog revenue.

Financial sources indicate that if White had sold the entire package of assets he was shopping, which included master recordings and publishing rights, he could have earned tens of millions. However, details regarding his recent sale to Sony, including whether it involved publishing rights, remain unclear.

In contrast, Morrissey’s attempts to sell his Smiths-related assets could yield a smaller return. Previous private negotiations indicated low income potential, possibly below $1 million in net annual income. Based on that income level, a deal might have resulted in a payout of $10 million to $15 million, significantly less than what White could have earned.

Morrissey’s latest efforts have already deterred potential buyers. Conflicts regarding his ownership claims compared to Marr’s rights complicate the due diligence process. Furthermore, his unpredictable public persona raises concerns among investors, as noted by a financial buyer who previously declined to pursue Morrissey’s assets.

This unfolding situation between Jack White and Morrissey not only reflects the broader dynamics of the music asset market but also underscores the financial intricacies involved in music ownership and revenue generation.