U.S. Government Rules Out Stake in Nvidia Following Intel Investment

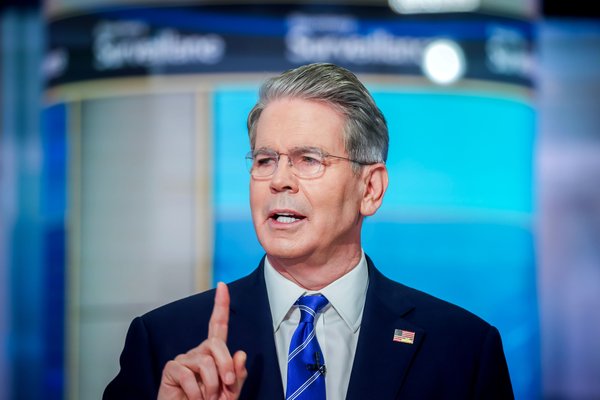

Treasury Secretary Scott Bessent announced on March 15, 2024, that the U.S. government does not intend to acquire a stake in Nvidia, despite recent actions aimed at increasing governmental involvement in key industries. His remarks came shortly after the Trump administration converted approximately $11 billion in subsidies and grants into a nearly 10% ownership in Intel.

Bessent emphasized that Nvidia does not require financial support from the government. He stated, “I don’t think Nvidia needs financial support, so that seems not on the table right now,” during an interview with Fox Business. He suggested that potential government investments could focus on critical sectors such as shipbuilding, which he described as essential for the nation’s self-sufficiency.

This statement follows the U.S. government’s recent stake in Intel, which is seen as a significant move toward direct ownership in American corporations. Bessent indicated that there might be opportunities for government investment in other industries crucial to national interests. He highlighted that critical sectors have been neglected for decades, asserting the need for the U.S. to be self-sufficient.

The Intel deal, which marks one of the clearest signs of governmental intervention in corporate America, has drawn both interest and concern. Fitch Ratings noted that the transaction improves liquidity for Intel but does not address the ongoing weak demand for its chips. Investor sentiment remains uneasy regarding the implications of increased government leverage over publicly traded companies.

James McRitchie, a shareholder activist who owns Intel stock, expressed his concerns, stating, “It sets a bad precedent if the president can just take 10% of a company by threatening the CEO.” These comments reflect a growing unease among investors regarding the government’s role in private enterprises.

Intel’s struggles in the market further complicate the situation. Once a dominant force in the personal computer chip sector, the company has lagged behind competitors like Nvidia in adapting to technological advancements in areas such as artificial intelligence and smartphones. Its stock has lost nearly half its value since 2020, prompting the U.S. to step in as the largest shareholder.

This approach mirrors strategies employed by governments in Europe and Asia, where backing “national champions” is common. For instance, China’s state-supported Semiconductor Manufacturing International Corporation (SMIC) plays a similar role in its industrial policy. Scott Lincicome from the Cato Institute remarked, “Once the U.S. government has an active stake in the success or failure of a company, it’s pretty hard to argue that it isn’t a ‘national champion.’”

Analysts caution that such arrangements can be difficult to reverse. Gary Hufbauer from the Peterson Institute for International Economics stated, “The state has already put down some money, and the tendency is to give it more support.” He noted that governments are often reluctant to withdraw from failing projects once taxpayer money is involved.

As the U.S. government navigates its role in private industry, the implications of such interventions remain to be seen. With significant investments in critical sectors, the administration’s approach could reshape the landscape of corporate America for years to come.