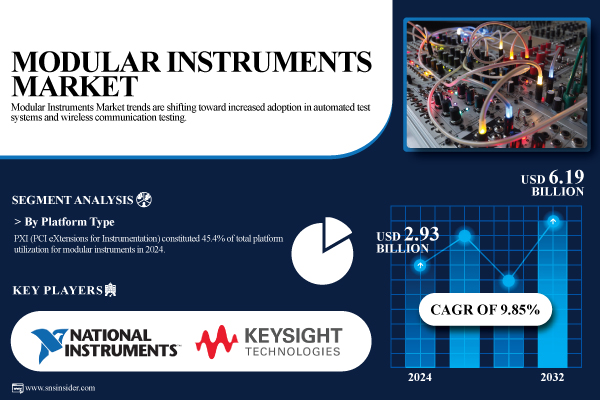

Modular Instruments Market Set to Exceed USD 6.19 Billion by 2032

The Modular Instruments Market is projected to grow significantly, with a valuation expected to reach USD 6.19 billion by 2032, according to research conducted by SNS Insider. The market was valued at USD 2.93 billion in 2024 and is forecasted to expand at a compound annual growth rate (CAGR) of 9.85% from 2025 to 2032.

Driving Forces Behind Market Expansion

Robust growth in the Modular Instruments Market is largely attributed to the increasing demand for flexible, scalable, and cost-effective testing solutions across multiple industries, including aerospace, defense, automotive, and telecommunications. The complexity of electronic devices is rising, coupled with miniaturization and the need for high-speed data processing, which are driving the adoption of modular systems, particularly in automated test setups and wireless communication testing.

The expansion of 5G networks, the proliferation of the Internet of Things (IoT), and advancements in autonomous technologies are further propelling market demand. These trends enable customizable platforms that shorten product development cycles and enhance performance validation. In the United States, federal investments in defense and aerospace modernization are fueling this growth, with companies like National Instruments noting significant demand for PXI-based systems in research and development activities related to electric vehicles (EVs) and aerospace.

Key Segments and Market Dynamics

In 2024, the PXI (PCI eXtensions for Instrumentation) platform accounted for 45.4% of modular instrument utilization. Its high-speed data transfer capabilities, compact form factor, and multi-instrument functionality make it the preferred standard in aerospace, defense, and telecommunications. Looking ahead, the AXIe (AdvancedTCA Extensions for Instrumentation) is anticipated to experience the fastest growth from 2025 to 2032, thanks to its open standard and scalable architecture, making it suitable for advanced applications like 5G testing and semiconductor validation.

By application, the Manufacturing and Production Testing segment led the market in 2024, holding a 34.6% market share. This segment benefits from the rising demand for rapid and high-throughput testing in the electronics, automotive, and semiconductor sectors. Modular systems offer fast cycle times and minimal downtime, ensuring product quality through flexible and scalable end-of-line testing.

Field testing is expected to grow at the fastest rate during the forecast period, driven by the increasing need for on-site diagnostics and validation across telecommunications, aerospace, and renewable energy sectors. These areas require portable, rugged, and remotely accessible modular instruments that provide real-time performance and reliability.

The hardware segment dominated the market in 2024, with a revenue share of 76.7%, largely due to the extensive use of chassis, controllers, and measurement modules in key industries. The software segment is poised for the highest growth, propelled by the demand for advanced test automation and data analytics solutions.

In terms of end-use industries, the electronics and semiconductor segment led with a 28.5% share in 2024. This growth is driven by the increasing complexity of semiconductor devices and the necessity for high-speed, accurate testing for chip design and validation. The telecommunications sector is projected to grow rapidly, fueled by global 5G adoption and rising data traffic.

North America captured the largest market share in 2024, with 36.4% of the total market, bolstered by a strong technological foundation and high R&D expenditure. The U.S. leads within this region due to its advanced defense and semiconductor industries. Conversely, the Asia Pacific region is expected to experience the fastest growth at a CAGR of 10.63%, driven by industrialization and government-backed digital transformation initiatives, with China emerging as a regional leader.

Recent developments in the market include the launch of the compact R&S NPA power analyzer family by Rohde & Schwarz in April 2025, which offers advanced testing capabilities for power and harmonic distortion measurements.

As the Modular Instruments Market continues to evolve, it presents numerous opportunities for vendors to innovate and expand their offerings, particularly in response to the dynamic needs of various industries.