Ford Bets $5 Billion on EV Future with Universal Platform

Ford Motor Company has announced a significant shift in its electric vehicle (EV) strategy with the introduction of the Universal EV Platform, a move that could redefine its position in the automotive market. During a presentation on August 15, 2025, CEO Jim Farley described the initiative as Ford’s “Model T moment,” emphasizing its ambition to produce affordable electric vehicles at scale. The company has committed $5 billion to support this venture, which aims to simplify manufacturing processes and utilize domestically produced lithium iron phosphate (LFP) batteries.

Despite the bold vision, Farley acknowledged the inherent risks associated with this strategy. He candidly told investors that there are no guarantees regarding its success and that Ford must navigate a challenging policy environment that could impact its goals. The current political climate has shifted dramatically since the initiative was first conceived, raising questions about the feasibility of the plan.

Market Conditions and Strategic Alignment

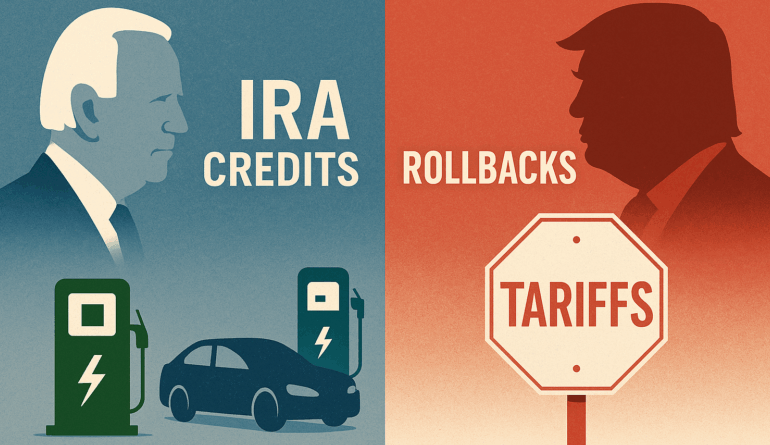

The groundwork for the Universal EV Platform began in 2022, when Ford initiated research in a skunkworks project in California. By 2024, the company had committed to the platform as U.S. policies, particularly under the Inflation Reduction Act, created a favorable environment for electrification. The Act provided $7,500 consumer credits for qualifying EVs, manufacturing credits for domestically produced batteries, and funding for charging infrastructure.

At that time, Ford’s diagnosis of the market was optimistic. A commitment to a flexible, high-volume, and low-cost EV architecture seemed prudent. The anticipated advantages included lower consumer prices and reduced production costs, supported by a clear vision of affordable EVs built with fewer components and simpler assembly processes.

The guiding policy focused on investing in advanced design and manufacturing to drive down EV costs while localizing the supply chain. Ford’s leadership identified cost as the primary barrier to mainstream EV adoption. The Universal EV Platform was designed to address these challenges through a coherent set of actions, such as reducing the total number of parts and utilizing a modular assembly process to cut production time.

However, the political landscape changed after the Trump administration took office. The administration eliminated the $7,500 consumer EV credit and reduced funding for charging infrastructure. Additionally, tariffs were imposed on imported steel and aluminum, increasing the costs associated with producing EVs and slowing the expansion of public charging networks. These changes have created significant headwinds for Ford’s ambitious plans.

Challenges Ahead and Future Prospects

Ford’s continued investment in the Universal EV Platform, despite these challenges, indicates a belief that the current political climate may soon shift back in favor of EV incentives. Farley and his team seem to be banking on the idea that a future administration will reinstate supportive policies before the platform’s products reach peak production.

The technical aspects of the Universal EV Platform are noteworthy. It features structural LFP battery packs produced in Michigan, a reimagined assembly process, and a zonal wiring architecture that reduces complexity and potential failure points. These innovations aim to deliver vehicles that are economically viable while maintaining quality and performance.

Yet, the platform faces limitations, particularly regarding range. With a base battery pack of approximately 51 kWh, the range may not meet the expectations of American consumers accustomed to long-distance travel. The lack of a robust charging network could further hinder market appeal in the U.S., where driving distances are often greater than in Europe or Asia.

Moreover, the platform’s design may not resonate with international markets. The vehicles, sized for North American standards, may struggle in regions with narrower roads and different consumer preferences. Competing against established brands like BYD, which offers longer-range EVs at competitive prices, adds another layer of challenge.

The Universal EV Platform does have potential in the commercial vehicle sector, where total cost of ownership can be more critical than upfront costs. Fleet operators in utilities, delivery services, and municipalities could benefit from the platform’s streamlined manufacturing and domestic battery production. In these contexts, the limitations of range may be less significant, allowing Ford to target segments that require practical solutions for daily operations.

As Ford forges ahead with its ambitious plans, it faces intensified competition from other automotive giants. Tesla recently launched a more affordable version of the Model Y, while General Motors is introducing its Ultium-based Equinox EV. Other manufacturers, including Toyota and Stellantis, are also advancing their electric offerings, intensifying the race for market share.

Ford’s decision to advance the Universal EV Platform during a turbulent political climate underscores the company’s strategy of resilience. If the political landscape shifts back towards pro-EV policies, the platform could find a receptive market. However, if current challenges persist, Ford may struggle to sell short-range EVs at a price point appealing to the wider audience, especially as competitors offer more attractive alternatives.

Ultimately, the success of Ford’s strategy will depend on its ability to navigate these evolving market conditions and execute its plans effectively. The alignment of diagnosis, guiding policy, and coherent actions was initially strong; now, the company must adapt to a changing environment that could either validate or undermine its bold investments in the future of electric vehicles.