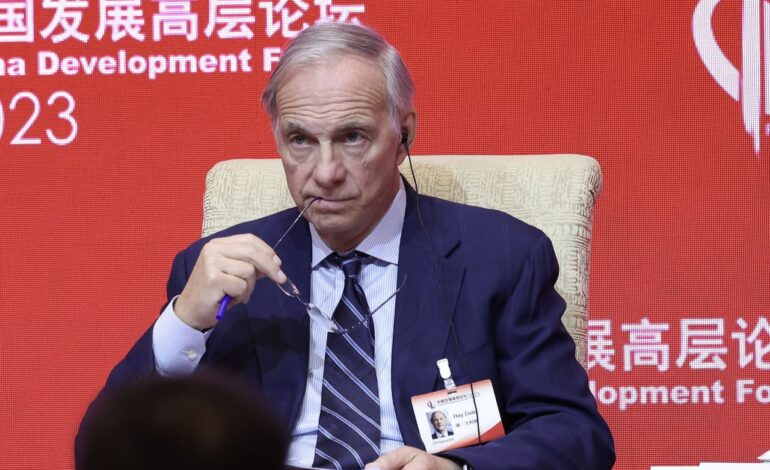

Ray Dalio Exits Bridgewater as Firm Liquidates China Assets

URGENT UPDATE: In a shocking move, Ray Dalio has officially exited Bridgewater Associates, coinciding with the firm’s strategic decision to liquidate its assets in China. This development comes as the Chinese market shows signs of a significant rebound, raising eyebrows among investors and analysts alike.

Bridgewater’s liquidation of its Chinese exposure is particularly striking, given the recent recovery in the Asian markets. Analysts report that the Hang Seng Index has surged by over 10% in the past month, highlighting the contrasting timing of Dalio’s departure and the firm’s withdrawal from such a crucial market.

This decision, announced earlier today, reflects not only the firm’s changing strategy but also a broader trend of Western financial firms reassessing their positions in China amid rising geopolitical tensions. Official sources indicate that Bridgewater’s exit from China is part of a larger reallocation of assets aimed at mitigating risk in an increasingly volatile environment.

Dalio, who founded Bridgewater in 1975, has long been a vocal proponent of investing in China, even amidst skepticism from other investors. His departure marks a significant shift for the firm, which managed over $160 billion in assets at its peak. With the firm now pivoting away from a market it once championed, investors are left questioning the future direction of Bridgewater.

The implications of this move are profound. As Bridgewater liquidates its holdings, the impact on global markets remains to be seen, but analysts predict a potential ripple effect in investor sentiment toward China. This could lead to a re-evaluation of existing investments and strategies among other firms still engaged in the region.

WHAT’S NEXT: Investors and market watchers will be closely monitoring how Bridgewater’s liquidation will influence market dynamics and whether other firms will follow suit. Additionally, Dalio’s future plans remain uncertain, leaving many to speculate on his next moves in the investment landscape.

This urgent update underscores the rapidly changing dynamics in the financial world as major players like Dalio make bold decisions that could reshape investment strategies on a global scale. As developments unfold, stakeholders are advised to stay informed on this critical situation.