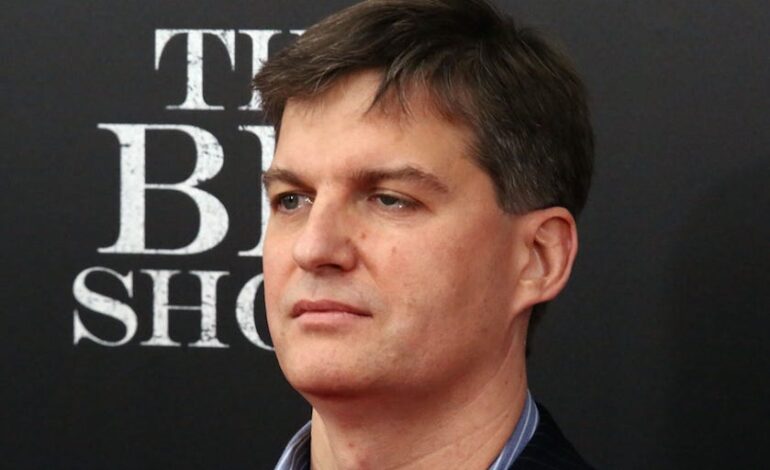

Michael Burry Bets Big on Meta, Alibaba, UnitedHealth Stocks

UPDATE: Prominent investor Michael Burry, famed for his role in “The Big Short,” has made significant moves in the stock market, revealing fresh bets on major companies including Meta, Alibaba, and UnitedHealth. Just announced in a quarterly filing, Burry’s Scion Asset Management has transitioned from bearish positions to bullish ones, indicating a major strategy shift.

In the second quarter of 2023, Burry’s fund held call options on nine stocks valued at a staggering $522 million by the end of June. This represents a remarkable overhaul from his previous bearish stance, where he held put options worth $186 million just three months earlier.

Burry’s newfound optimism is evident with his investments in high-profile companies: he has acquired calls on Alibaba, ASML, JD.com, Estee Lauder, Lululemon, Meta, Regeneron, UnitedHealth, and VF Corporation. Additionally, his fund increased direct stakes in Bruker, Lululemon, Regeneron, UnitedHealth, and MercadoLibre, while reducing his Estee Lauder shares from 200,000 to 150,000.

The investment in UnitedHealth is particularly noteworthy, as it aligns with similar moves by Warren Buffett, who also invested in the health insurer through Berkshire Hathaway last quarter. This connection highlights the importance of Burry’s strategy, as he navigates a volatile market landscape.

Call options allow investors to purchase stocks at a predetermined price, providing a strategic advantage if the market price increases. Burry’s shift from put options—designed to profit from stock declines—signals a confident outlook amidst fluctuating market conditions.

Scion Asset Management is known for its dynamic portfolio adjustments, and this latest update reflects a particularly aggressive recalibration. The company’s filings reveal a shift from holding puts on companies like Nvidia and Trip.com to a more diversified approach with bullish positions across multiple sectors.

However, it’s essential to remember that Burry’s quarterly portfolio updates, known as 13Fs, only provide a snapshot of his holdings with a six-week delay. This means the full scope of his investment strategy may not be fully represented, as they exclude short-sold shares and private investments.

Burry rose to fame by predicting the collapse of the mid-2000s U.S. housing bubble, a gamble that was immortalized in “The Big Short.” Known for his bold market predictions, he has made headlines for betting against popular stocks like Tesla and Apple, as well as the entire S&P 500 index.

As Burry’s strategies attract renewed attention, investors and analysts alike will be closely monitoring his next moves. Will this bullish shift lead to significant gains, or is it a temporary strategy in a turbulent market? Stay tuned as we track Burry’s evolving investment landscape.